Profitable Renko Strategy – Building Your Account, One Brick at a Time

The Renko Profitable Strategy is designed to reproduce the sound of many markets produced by standard candlestick charts. If you are tired of using the same old Japanese candlestick chart, we would like to introduce you to the Renko chart. By using the Renko chart, we eliminate the time element and focus only on the price that isolates the trend.

If this is your first time on our website, our team at Trading Strategy Traders welcomes you. Make sure you hit the subscribe button, so you get your Free Trading Strategy every week straight into your email box.

When you actively manage the market (scalping, day trading), it is important to have a methodology to clean the market noise. Renko trading strategies are time independent and give you a unique way to see price action.

While free Renko charts can be used across different asset classes, including cryptocurrencies, our simple Renko system is designed, but not limited, to use in the Forex market.

In this trading tutorial, we will teach you what forex Renko forex is, how to use Renko charts in your trading, and how to optimize Renko brick sizes.

What is a Renko Chart?

A Renko chart is a technical tool or chart type built using only price data. Unlike Japanese candlestick charts, which are constructed using price, time and volume, Renko charts only measure price movements.

Renko has no time dimension.

Renko charts are not some secret hidden since the days of Japan as some trading gurus would have you believe. Renko bars were actually developed decades ago.

The name Renko means brick in Japanese and comes from the word “renga.” T hese charts are sometimes referred to as brick charts by traders.

Steve Nison who is the father of modern candlestick charts is the man who actually made forex Renko charts popular. These charts are often compared to traditional candlesticks but have some key differences. Although candlestick charts have varying lengths of “wicks” throughout, Renko bricks are the same size.

Easy-to-find bricks on a Renko chart make it easier to read the market and make quick decisions. These charts are suitable for day traders, although they can be used by traders who use time periods. By removing the stormy part of candlestick charts used for long-term trading strategies, Renko charts make it possible to determine where the market is actually moving.

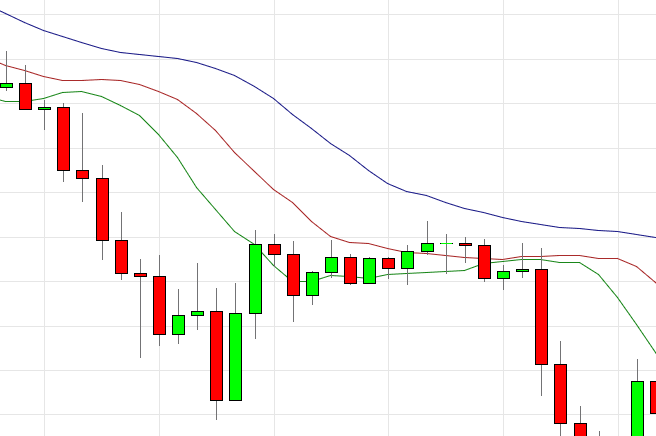

See below the difference between the popular Japanese candlestick chart and the live Renko chart:

The difference between these two chart types is quite visible. Renko charts do a better job of smoothing price action.

Let’s go one step further and learn how Renko bricks are formed.

To use a profitable Renko strategy, you really need to understand the basic fundamentals of Renko blocks

Each candlestick on a Renko chart is called a brick because it has the shape of a building brick. The rectangular bricks used to build the walls are about the same size. The same goes for Renko charts; each brick is the same size. Renko brick size is user defined.

How to Read and Construct Renko Trading Charts

Reading Renko charts is easy. Since the bricks have a fixed size, they can all be compared to each other. The color (and direction) of a Renko brick will change when the value of the previous brick has been exceeded. This indicates to traders that the trend is changing and the price is likely to move in the opposite direction.

Each mile represents a price range (example – $0.25). However, even though the bricks are of average size in the same graph, they can be adapted to your trading objectives. Individuals who open and hold longer, high cap positions will use different brick sizes than penny stock day traders.

We recommend using the average true range—or, ATR for short—to build each brick. ATR is derived from the closing price of the stock. This means that the Renko chart is a lagging indicator. In the next step, we will show you how to read Renko bars.

Note #1: if you use Renko bars with sticks or tails, then some bricks may display additional sticks either above or below the brick. But the size of the brick remains the same.

On the Chartview charting platform, you can go to Chart Settings – Style – Wick, and choose how you want the bricks to be displayed, with or without wicks.

Before getting back to Renko brick by brick, let’s give you the basics or basics of Renko bricks.

We have established that the size of the brick is determined by the user. If you are trading with a Renko chart, and the brick size you like is 20 pips, then a brick is only formed when the price moves up or down by 20 pips.

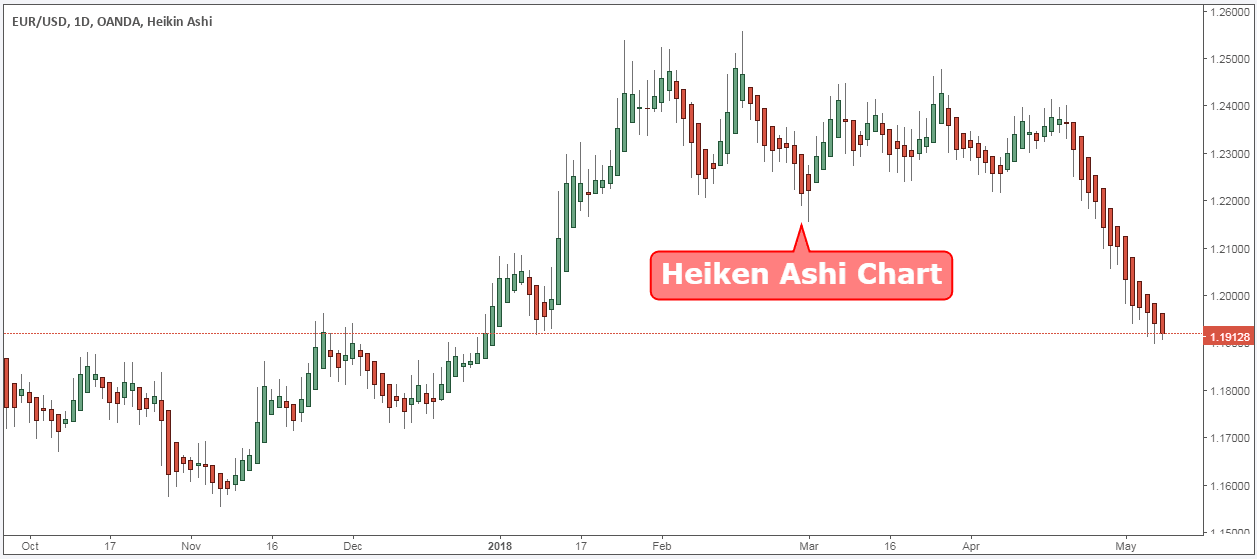

The best way to illustrate this concept is to look at Renko blocks through the eyes of a candlestick chart. In the EUR/USD 5 minute candlestick chart below, we highlight the 20 pips price movement area.

A green Renko brick will form only after the price will advance 20 pips. On the other hand, a red Renko brick will form only after the price drops 20 pips.

As you can tell, the time span between each brick is inconsistent.

In our EUR/USD chart example, the length of time it takes to print one Renko block varies from 20 minutes up to 1 hour and 45 minutes.

It’s clear that the Renko is less noisy and cuts through a lot of noise between swing highs and swing highs.

Important note: When you trade with a Renko chart, the price needs to travel twice the price range of your brick for the Renko brick to change color.

For example, if the brick size remains 20, it means that we need to move 40 pips for the red brick that will be printed after we have the green brick.

Let’s go back for a second why do some blocks have bricks?

Trading Renko charts with wicks can be a very powerful tool in your trading arsenal. Bricks with wicks give us further clues about the battle between the bull and the bear.

The wicks printed on the Renko bricks are only when there is a strong attempt to produce a reversal (a brick color change from green to red and vice versa), but fails. The wick will only show you how many pips it went in the opposite direction.

Note # 3: a wick is printed on a brick only when the price moves in the opposite direction of the previous candle by at least the length of +1 brick.

Let’s see how you can optimize Renko blocks, and how to choose the right Renko brick size.

How to choose the right Renko Brick Size?

If you don’t know what the right size is for a Renko chart at that time, we have a solution.

If we want a dynamic reading of the price through the Renko block, we can use the brick size determined by the ATR (Average True Range). Instead of choosing random brick sizes, this will give you dynamic support and a more accurate level of resistance.

ATR will automatically detect the correct brick size that is more in line with price action.

Note #4: The downside of using Renko-based ATR chart sizes is that when the ATR value changes, your Renko bricks are redrawn to reflect the new change.

When choosing your Renko brick size, ask yourself the following questions:

- What are my goals as a trader?

- What are my time constraints? What is the cost to trade?

- Do I open a small position or a larger position?

- Do I consider myself at risk or not at risk?

If you are chasing lower and lower risk positions over a longer period of time, then it makes sense to use larger Renko brick sizes. On the other hand, if you’re chasing high-risk positions that require attention to volatility, then smaller bricks will be better.

Let’s learn how to trade Renko charts the right way.

See below:

Simple Renko System

We will suggest two trading strategies that you can use with Renko blocks. The first simple Renko system is an indicator-based strategy that uses price momentum differences to identify trend reversals.

Renko Trading Strategy #1

For this Renko trading strategy, we only need to use the RSI indicator. We like to use the 20-period RSI indicator. So, the period is equal to the ATR Renko brick size.

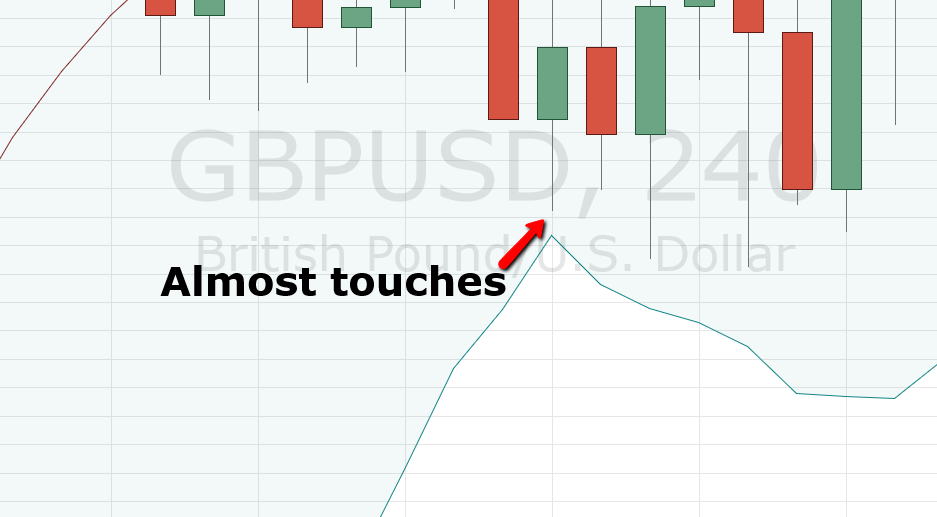

Check out the Renko scalping chart below:

After we see a momentum divergence, an entry signal is triggered when we get a reversal. On a Renko chart, a trend reversal is set in motion when the brick changes color. In this case, when we see a bearish divergence, enter a short position after the brick turns red.

For the price difference, wait for the brick to turn green.

We exit our profitable trade when another reversal pattern forms in the opposite direction of our trade. As a method to protect our account balance and not lose too much, you can place your SL above and below the swing point developed after your entry.

A lot of the noise that exists in time-based charts remains eliminated. Therefore, if you trade with Renko charts, spotting divergences and trend reversals is easier. RSI is the best indicator to use with Renko.

Renko Trading Strategy #2

A better Renko strategy you can use is to focus on bricks only.

No additional technical tools are required for this system.

We will explore a very simple and very powerful Renko chart pattern that combines wicks. This Renko price pattern looks for two consecutive bricks of the same color and both bricks have a brick.

The location of this Renko pattern is not very important. It can be at the end or middle of the trend. This pattern has a very high success rate if traded in the right context. You need to look around these two brick patterns and make sure the block does not move back in the trading range.

If not, then you have the green light to take the signal generated by this trading setup.

The entry is on the third brick after the two bricks that have bricks. Stops can be placed on wicks and exits when a reversal pattern is produced.

Conclusion – Renko Trading Strategy

Renko bars ensure that you have a better and cleaner representation of the price action. If you are having difficulty reading prices on candlestick charts, it may be time to look elsewhere. Trading with our profitable Renko strategy could be right for you.

We truly believe that Forex Renko charts are more suitable for traders who are still struggling to analyze candlestick charts. The Renko trading strategies presented in this trading guide are just an introduction to the world of Renko bricks. We hope you now have a clear idea of the possible possibilities using this new charting technique. Don’t forget to read our Chart Pattern Trading Strategy.