The wedge trading strategy is a reversal trading strategy that has the potential to generate huge profits. When it comes to price action trading, the most important thing is to recognize certain patterns in the market. Our team at Trading Strategy Trader has dedicated a lot of time to teaching you the most popular and profitable price patterns, similar to the Head and Shoulders Price Pattern Strategy.

In this guide, we will teach you how to define, or what defines, a falling wedge pattern and a symmetrical wedge pattern. They are almost the same pattern, but not the same.

As with most price patterns, you can trade this pattern in any market and at any time. No matter what type of trader you are – swing trader, day trader, and scalper – you can make huge profits trading falling wedge patterns.

Regardless of the environment you see the wedge pattern falling in shape and the information it actually offers you with the price pattern has a definite bullish bias. Going forward, we will focus on recognizing falling wedge patterns and symmetrical wedge patterns and then we want to focus on how to trade strategies effectively.

Note * No technical indicators are required to manage the wedge trading strategy. This is because we deal with pure price trading strategies.

Before we begin to cover in depth the rules of strategy, we will define and learn how to get to know each person. Also read about Forex Mentors and the best investments you can make.

Falling Patterns Explained

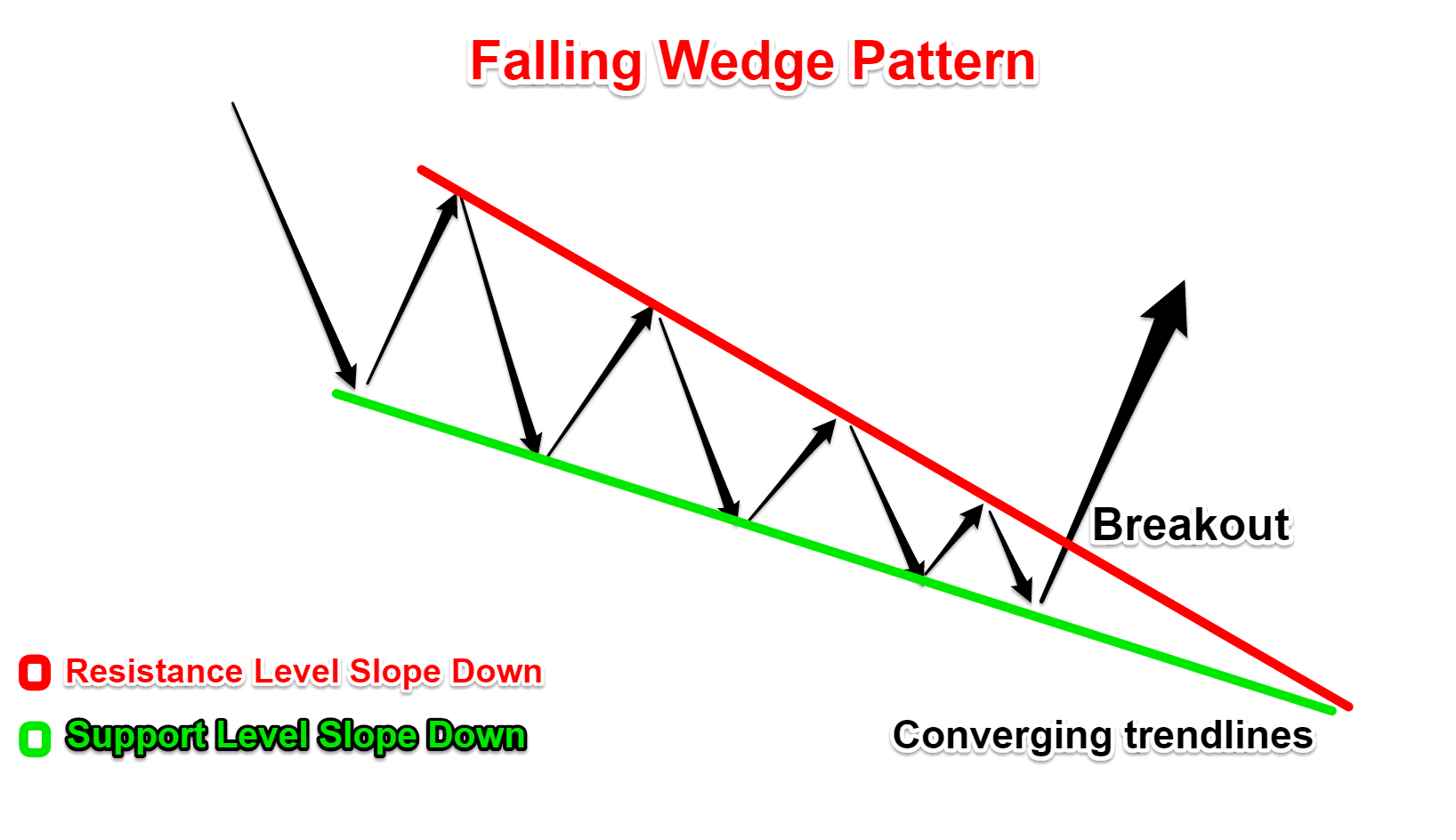

It is important to recognize that the falling wedge pattern has two parts in the price pattern structure:

- The main feature of the falling wedge pattern is that we need to have a downtrend before the pattern develops. This is because it is a reversal pattern.

- The second part is an actual falling wedge pattern that looks like a downward pointing triangle.

Now, how to recognize the price structure of the falling wedge pattern?

You should have a series of low highs followed by a series of lows down, the more the better. Each lower point should be lower than the previous level and each higher point should be lower than the previous level.

However, when we approach the falling wedge pattern, you will notice that the price will fail to make a low.

Even as the falling wedge pattern develops, you will see the swing wavelength become tighter and tighter. Especially when we move down. And in the future, two trendlines that connect the high and the low will converge.

A falling wedge pattern is not confirmed until it breaks to upside resistance.

We can definitely say that there are some common features between the falling wedge pattern and the rising flag pattern but the difference is that the flag pattern is more of a short-term aggressive pattern while the wedge pattern is more of a long-term price action. We also have training for the best short-term trading strategies.

Before jumping into the rules, we still need to define our second favorite pattern the symmetrical wedge pattern.

Symmetrical Wedge Patterns Explained

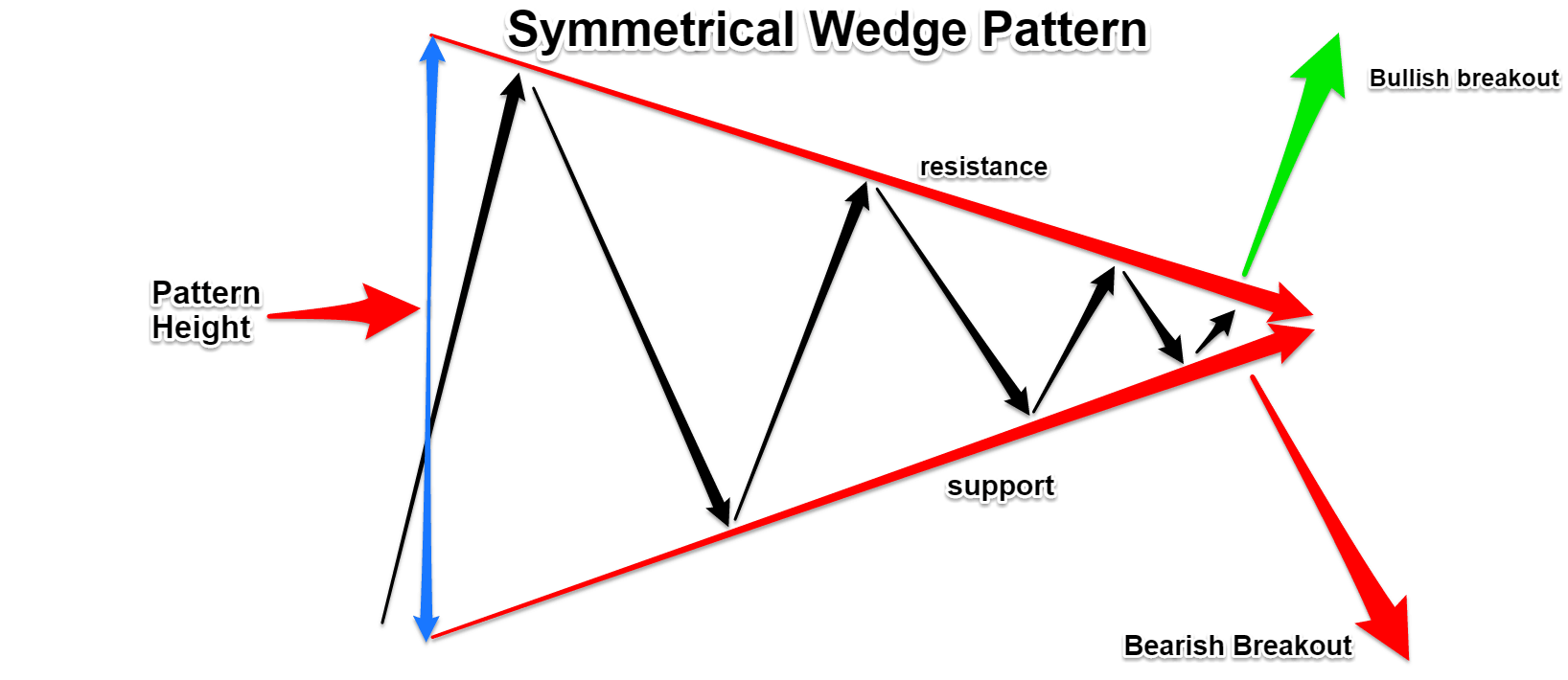

The symmetrical wedge pattern is another simple price action pattern. It is constructed similarly to the falling wedge pattern. A symmetrical wedge pattern has a symmetrical triangular shape. It can be recognized by the distinct shape created by two diverging trend lines.

This is identified by drawing two trendlines:

- A downward resistance trendline that connects a series of consecutive peaks.

- An ascending support trendline that connects several consecutively lower series.

And in the future, the two trendlines connecting the high and the low will meet on the right side of the pattern.

There are many opportunities to trade symmetrical wedge patterns. This pattern can appear at the end of an uptrend as well as at the end of a downtrend. More than just a reversal pattern, this can also be traded as a continuation pattern.

Often times, a break through one of the two trendlines will lead to an uncertain directional move. Your job as a trader is to wait patiently and only enter once the breakout occurs.

Now, let’s see how you can effectively trade falling wedge patterns and symmetrical wedge patterns. Just follow the rules of the wedge trading strategy below.

Wedge Trading Strategy Rules – Buying Opportunities

As a general rule, we need to remember that, the longer the market combines between the upper and lower limits of the falling wedge pattern and the symmetrical wedge pattern, the higher the probability of a breakout occurring sooner rather than later.

First, we will focus on the falling wedge pattern because it has tremendous profit potential to be made.

Step #1: Wait until you can Spot on the Price Chart a Falling Wedge Pattern Structure and Draw two trendlines connecting the highs and lows.

We are only looking for a visual representation of the falling wedge pattern. Therefore, a more compressed pattern is better. Finally, we’ll break in. The downside on the back of the breakout will push prices higher quickly.

Note ** You will often find that the shape and price structure of a falling wedge pattern can vary from pattern to pattern. Ideally, as long as we follow the definitions given earlier, we are good to trade any falling wedge pattern that respects those rules

Next, we need to know where we need to enter the trade, which brings us to the next step:

Step #2: Buy when we break and Close above the Downward Resistance Trendline

It is important before the breakout to look at the price contract in two trendlines. Therefore, when the price hits the resistance trendline, sellers will step in and when the price hits the support trendline, buyers will step in.

Finally, we get the price squeezed in this bound action.

As we get tighter and tighter that’s what we focus on when the build up in stress will eventually lead to escape. To avoid false breakouts, we will also wait on the upper slope before we actually buy.

Note *** We need to have enough energy and enough momentum to break above the resistance level on the falling wedge pattern. If you’re still having trouble identifying genuine breakouts, we highly recommend taking a quick look at our Breakout Trading Strategies Used by Professional Traders.

Now that we are in the trade we need to find our target, which brings us to the next step.

Step #3: Take Profits Once We Break Above the Origin (Starting Point) of the Falling Wedge Pattern

The starting point of the falling wedge pattern is our first wall of defense and obviously, we want to distribute our profits in the first problem area. This is a more conservative target.

Alternatively, you can trace your stop loss below each swing low and try to capture as much as possible from the new trend.

Now that we have a good understanding of where to take profit, there is still one more thing that we need to be careful about, which is the placement of the Stop Loss.

Step #4: Place a Protective SL under the last swing before the Breakout

The place where we will hide our stop loss is quite intuitive to think about. The last swing low before the breakout can give us a very attractive risk compared to the potential profit available.

A break below the last swing will invalidate the falling wedge price structure so we want to minimize losses and exit the trade.

Note * The above is an example of a buy trade… For a sell trade, we need to trade a “cousin” pattern which is a rising wedge pattern. Use the same rules – but in reverse – for sell trades.

The symmetrical wedge pattern follows the same resistance trading strategy rules, but the only difference is that we have a more practical way of measuring our profit targets.

For our profit target, we will measure the distance between the highest point and the lowest point of our symmetrical wedge pattern and you will add that distance to wherever the breakout price occurs.

Summary

The reason why we have chosen to use falling wedge patterns and symmetrical wedge patterns is because people will not realize what is developing until after the breakout, but if you train your eyes to see these price patterns first big profits are waiting for you down the line. You can also trade with the breakout triangle strategy.

The psychology behind the falling wedge pattern is because the price action shrinks the buyers to become more aggressive while the sellers don’t have enough power to keep pushing the paddle.

If you compress an object hard enough after reaching the maximum compression level, it will harden again. The same principle can be applied to the falling wedge pattern which is the reason why it has an incredible potential to make huge profits.

Thank you for reading!