Trading technical indicators with binary options can be a very profitable trading style – if you know how to do it right. Our article explains the basics and three examples of strategies you can use. In detail, you will learn:

- What are Technical Indicators?

- Why Are Technical Indicators And Digital Options A Great Combination?

- Three Examples of Strategies For Technical Indicators

With this information, you will immediately be trading binary options with technical indicators.

What are Indicators?

Technical indicators are useful trading tools that allow price action traders to understand what is happening in the market and make predictions about what will happen next. Some indicators pull their results directly into a price chart, which makes it easy for analysts to compare them with current market prices. Other indicators use a separate window to display the results. The most famous example of this type of indicator is the oscillator. This indicator creates a value that oscillates between 0 and 100. This value and its changes over time allow you to understand what happened in the past and what will happen next. There are thousands of pointers, but these are the most important types and some examples:

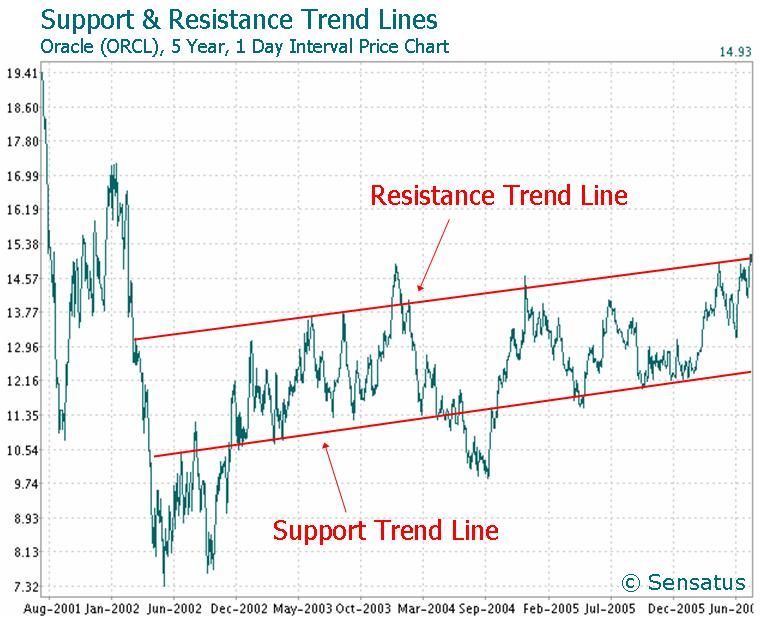

- Support & resistance: This indicator predicts support and resistance levels where the market is likely to turn. When it breaks such a level, it may create a strong movement from the price level. Examples: Bottom, Fibonacci Shift, Pivot Point (PP), Top.

- Trend: This indicator helps you assess the strength and credibility of the trend. Examples: Directional average index (ADX), Commodity channel index (CCI), Detailed price oscillator (DPO), Know the sure thing oscillator (KST), Ichimoku Kinkō Hyō, Moving average converging / ), Parabolic SAR (SAR), smart money index (SMI), Trix Vortex Indicator (VI).

- Momentum: This indicator helps you understand the momentum of the movement. Examples: Money flow index (MFI), Relative strength index (RSI), Stochastic oscillator, True strength index (TSI), Ultimate Williams oscillator %R (%R).

- Trading volume: This indicator uses trading volume (the number of assets sold or bought) to assess whether investors are bullish or bearish. Examples: Accumulation / distribution line, Ease of Movement (EMV), Strength Index (FI), Negative Volume Index (NVI), Remaining Volume (OBV), Turnover Ratio / .

- Volatility Indicator: This indicator measures the strength of the movement, which helps traders make various predictions, especially for binary options types that use target prices, for example a touch option, a border option, or a ladder option. Examples: Average true range (ATR), Bollinger Band (BB), Donchian channel, Keltner channel, CBOE, Market Volatility Index (VIX), standard deviation (σ).

No need to learn all these pointers. Take a look at each category, pick the one you like, and take it from there. It is better to start with indicators that you really understand and like. Then you can add more indicators to your strategy, allowing your trades to evolve naturally.

Why Device Indicators Suit Indicators?

Most binary options traders rely heavily on technical indicators. There are three main reasons for this strong connection between binary options and technical indicators:

- Technical indicators facilitate the analysis of price action. Price action is the only way to predict what will happen on a short time frame like you use in binary options. Just looking at price movements can be misleading, though. Technical indicators can filter important information on a price chart and display it in a way that everyone can understand immediately. This simplification makes your trading faster and easier.

- Indicators secure your trade. When you analyze the market without any help, there is a lot of information to take in. Complexity leads to mistakes and bad decisions, both of which cost you money. Technical indicators eliminate these mistakes, which is why they help you make more money in an easier way – a great combination.

- Indicators can reveal things that traders cannot. In a split second, technical indicators analyze hundreds of datasets, sift through the most relevant information, and display it in a way that everyone can understand. Without the help of technical indicators, much of this information is inaccessible. It took several years to calculate Bollinger bands for fifty assets with ten times each time. Technical analysis adds a layer of information to your trade that might otherwise be hidden.

These things are the reason why technical indicators and binary options are a great combination.

What Are Key Indicators?

A leading indicator is a special form of market indicator. Market indicators are everything that helps you understand whether the price of an asset will go up or down in the future. They provide important, useful, and easy to interpret tools for binary options traders. With the right strategy, they can help you anticipate new market movements and find the right time to invest. These indicators can be categorized into two types:

- Key pointers. This type of indicator predicts what will happen to the asset price.

- Lag indicator. This type of indicator tells you what has happened to the asset price. While this information should help you predict what will happen next, the clues themselves focus on the past – this is the big difference between the two types of clues.

The goal of a leading indicator is to give you a sense of where an asset’s price is headed. A great example of a leading indicator from another field is the business climate index. Business managers report their expectations for the future, and the index creates an aggregate value that can be easily compared to previous months and years. Its value and changes over time help you to predict whether the economy will improve or worsen. Major financial indicators do the same. They measure things, and the resulting values tell you whether things are going to get better or worse.

Why should I use Key Indicators?

Leading indicators serve a very important purpose: they can help you understand whether the current movement is more likely to continue or end soon. With these pointers, you can find great trading opportunities and avoid bad ones. For example, suppose you find an upward movement.

- If your leading indicator is telling you that the move is likely to continue, you know that it is a good time to trade the bullish option.

- If your leading indicator is telling you that the move is likely to end soon, you know that now is not the right time to trade high options. You should either be from the market or trade an option that predicts the end of the move.

For any trend follower, swing trader, and just about anyone else, leading indicators add important information to their trading style. They can help filter out bad signals, find new business opportunities, and win more trades.

Popular Examples of Lead Indicators

There are hundreds of key indicators. Some of them are the same, some are very different. To help you understand leading indicators better, we will look at three examples of leading indicators that will allow you to get a feel for a variety of different leading indicators.

Example 1: Money Flow Index (MFI)

The Money Flow Index (MFI) is a popular leading indicator because it helps traders quickly assess the strength of trends. As the name suggests, MFI compares the money flowing into an asset to the money flowing out of it. For this purpose, it multiplies the average of each high, low, and closing price by the total period and then divides the sum of all periods with rising prices by the sum of all periods with falling prices.

The result is a value between 0 and 100.

- When the MFI reads 100, all that money flows into assets – all periods are displayed as increasing periods.

- When the MFK reads 0, all the money is flowing out of the asset – all periods show the price falling.

- When the MFI reads 50, the amount of assets sold and bought are equal.

Any value above 50 indicates that more people are selling than buying the asset, any value below 50 indicates the opposite. MFI readings and their changes over time allow two predictions about future market movements:

- Extreme value. When the LKM is too high (usually above 70) or too low (usually less than 30), the market enters extreme territory. Traders assume that such extreme values indicate that too many traders have bought or sold the asset and there are no more traders who can buy or sell the asset and maintain the movement. As a result, they predict that the movement is in trouble and will soon reverse or go through consolidation before it can continue. Some traders use this signal to stop investing in movements; some invest in the opposite direction.

- Convergence / divergence. When the market makes a new extreme in a trend (a new high in an uptrend or a new low in a downtrend), the MFI should reflect this movement and make a new extreme as well. When the MFK does not reflect the market’s new high/low with its own high/low, the trader has stopped bucking the trend. While this is still sufficient to establish a new extreme, a continued decline in momentum will end the trade. Some traders will use this signal to stop investing in the trend, some will invest in the opposite direction.

Of course, you can also interpret MFI in the opposite way:

- When the MFI reads between 30 and 70, there is enough room for the market to continue its current move. Most traders will predict that the movement will continue for a while and invest accordingly.

- When the MFI reflects the current trend, the trend remains intact. Most traders will predict that the trend will continue and invest accordingly.

MFI is a key indicator because it predicts that a trend or movement will continue or end soon. The lagging indicator will only tell you what happened to the movement in the past. Because the LKM value oscillates between 0 and 100, it is called an oscillator. Most other oscillators are also leading indicators. If you like a simple idea to determine your investment decision, please take a look at the technical analysis of other oscillators.

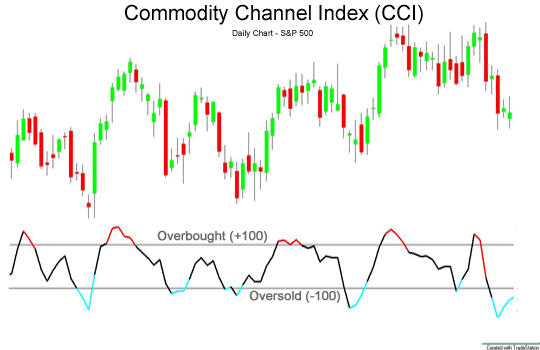

Example 2: Commodity Code Index (CCI)

Don’t let the name fool you – Commodity Channel Commodity (CCI) works with all types of assets, not just commodities. Simply put, the CCI calculates the extent to which an asset has diverged from its statistical average. The theory is that when an asset has deviated too far from its mean price, it will immediately revert. Just like LKM, CCI assumes that when too many traders have bought or sold an asset, there is nothing left to push the market further in this direction. It needs to twist and unify.

In detail, the CCI multiplies the average of the final high, low, and close price by 0.015 and places the result in relation to the launched moving average.

- A value above 100 indicates that the asset is trading higher than 1.015 times its moving average value.

- A value below -100 indicates that the asset is trading lower than 0.985 times its moving average value.

In both cases, the CCI predicts that the market has moved too far from its moving average and that the movement will soon reverse. Some traders also wait before they invest.

- When the CCI has risen above 100, they wait until it falls before they invest.

- When the CCI falls below -100, they wait until it starts to rise before they invest.

This trader uses the CCI as a lag indicator. To use the CCI as a leading indicator, you need to invest when the market crosses the + 100 / -100 line – then you are investing in anticipation. When you trade a reversal, you invest in a reaction and use the CCI as a lagging indicator. Sometimes the line between lagging indicators and leading ones can be thin. As long as you know the difference and trade accordingly, you should be fine.

Example 3: Relative Strength Index (RSI)

At first glance, the Relative Strength Index (RSI) appears to be very similar to the Money Flow Index (MFI). Both are oscillators, creating values between 0 and 100, and using overbought and oversold areas. The difference between the two indicators is that RSI only focuses on price changes while MFI also considers volume per period. While the RSI treats each period equally, the MFI places more weight on periods with high volume and less weight on periods with low volume.

Also, you can use RSI like MFI. Trade differences and oversold areas above 70 or below 30. When the RSI is between 30 and 70 the current movement still needs to have some room; when it reflects a trend, the trend is fine. Both MFI and RSI are always better. Which indicator you should use depends on your strategy, your personality, and your beliefs about the market.

- Some traders argue that they sell price, not volume and that they should, therefore, ignore volume. They also say that the numbers are too similar on the short time frame of binary options to have an effect. This trader should use RSI.

- Some traders argue that the volume has a significant impact because it tells you which direction more traders support. These traders should use LKM.

Primary With Binary

All leading indicators can be the sole basis of your trading strategy or an additional feature to your current strategy to filter signals. We will present strategies that use key indicators in both ways.

Strategy 1: MFI Divergence Trade With High / Low Options

We have shown that the MFI reflects an intact trend.

- When an intact uptrend creates a new high, the MFI creates a new high as well.

- When an intact downtrend creates a new low, the MFI creates a new low.

When an MFI fails to reflect a new extreme trend, the trend is in trouble. This trend is losing momentum, and while it still has enough power to create new extremes, it looks like this is the last extreme trend. High/low options offer the perfect tool to trade with these predictions.

- When MFIs ease in the uptrend, invest in low options.

- When MFIs ease in the downtrend, invest in high options.

An important part of this strategy is getting the expiration right. While it is likely that the market will follow the MFI divergence by changing direction or entering a sideways movement, these movements take time to develop. It is important that you choose your expiration to provide the market at this time. When you find an MFI divergence in a 5-minute chart, for example, a 15-minute expiration is not enough. The market will take at least 10 periods to reverse, and a 15-minute expiration is only equivalent to 3 bars. Choose an hourly expiration, and you increase the chances of winning the trade. You can also trade this strategy with RSI. You will only change the indicator, without changing anything else. In addition, you can replace high / low options with low-risk ladder options.

- After the LKM divergence in an uptrend, you predict that the market will trade lower than the price above the current market price.

- After the LKM divergence is in a downtrend, you predict that the market will trade higher than the price that is below the current market price.

This is a safer version of the strategy. Instead of using the current market price as a reference point for your forecast, you use a price that is far in the direction you expect the market to move. This strategy will win you a higher percentage of your trades but also give you lower payouts. Decide for yourself which strategy you want to use.

Strategy 2: Trend Filtering With RSI

The following strategies follow a simple trend:

- In an uptrend, invest in rising prices.

- In a downtrend, invest in falling prices.

Despite this simplicity, many traders fear that they may be investing in a trend that will soon end. These traders can use RSI to filter signals.

- When the RSI reflects a trend, invest in the trend.

- When the RSI deviates from the trend, do not invest in the trend.

Adding RSI to trend-trending strategies can help traders to win a higher percentage of their trades and make more money with a simple check. Continue with your unchanged strategy. Use the same expiration as before and invest the same percentage of your overall account balance per trade.

Strategy 3: Manage MFI extreme areas with high / low options

In addition to divergence, MFI also makes predictions when movements enter extreme areas. These predictions enable simple trading strategies:

- When MFIs enter overbought territory, invest in low options.

- When MFIs enter oversold territory, invest in inferior options.

The success of this strategy depends on your ability to choose the right expiration. The market takes some time to turn, so you must avoid too short an expiration. When you choose your expiration too long, on the other hand, the movement may end at the time your choice expires. Experience will help you find the right expiration. The perfect setup depends on the situation, the period of your chart, and the characteristics of the asset. If you’re looking for a rough number to start with, try for 5 periods, then take it from there. As with the first strategy, you can also trade this strategy based on RSI or with low-risk ladder options.

Key Indicators – Summary

Leading indicators are important, useful, and easy-to-interpret market analysis tools. Binary options traders can use leading indicators as the sole basis of their strategy or to filter signals. They are very helpful to find the right time and avoid bad trading opportunities.

What is Lagging Indicator?

Lagging indicators are an important aspect of any market analysis strategy. This article explains everything you need to know to trade binary options based on lagging indicators. You will also understand the advantages, disadvantages, and ideal areas of use. The difference between leading and lagging trading indicators is the same.

- Significant trading indicators tell you what happened to asset prices in the past in a way that helps you predict what will happen next.

- Leading indicators analyze other factors and predict how they will affect asset prices.

This difference is why lagging indicators are so useful during trend periods. When the market is in a trend, lagging indicators can help you make great predictions; but when the market is stationary, many lag indicators use their predictive quality. Lagging indicators serve an important purpose and are an important part of a market analysis strategy. To see how you can use lag indicators for your trading, let’s take a closer look at three popular examples of lag indicators.

Popular Examples of Lagging Indicators

There are hundreds of pointers out there, but let’s keep things simple. Here are the three most popular lagging indicators every trader should know.

Example 1: Trend

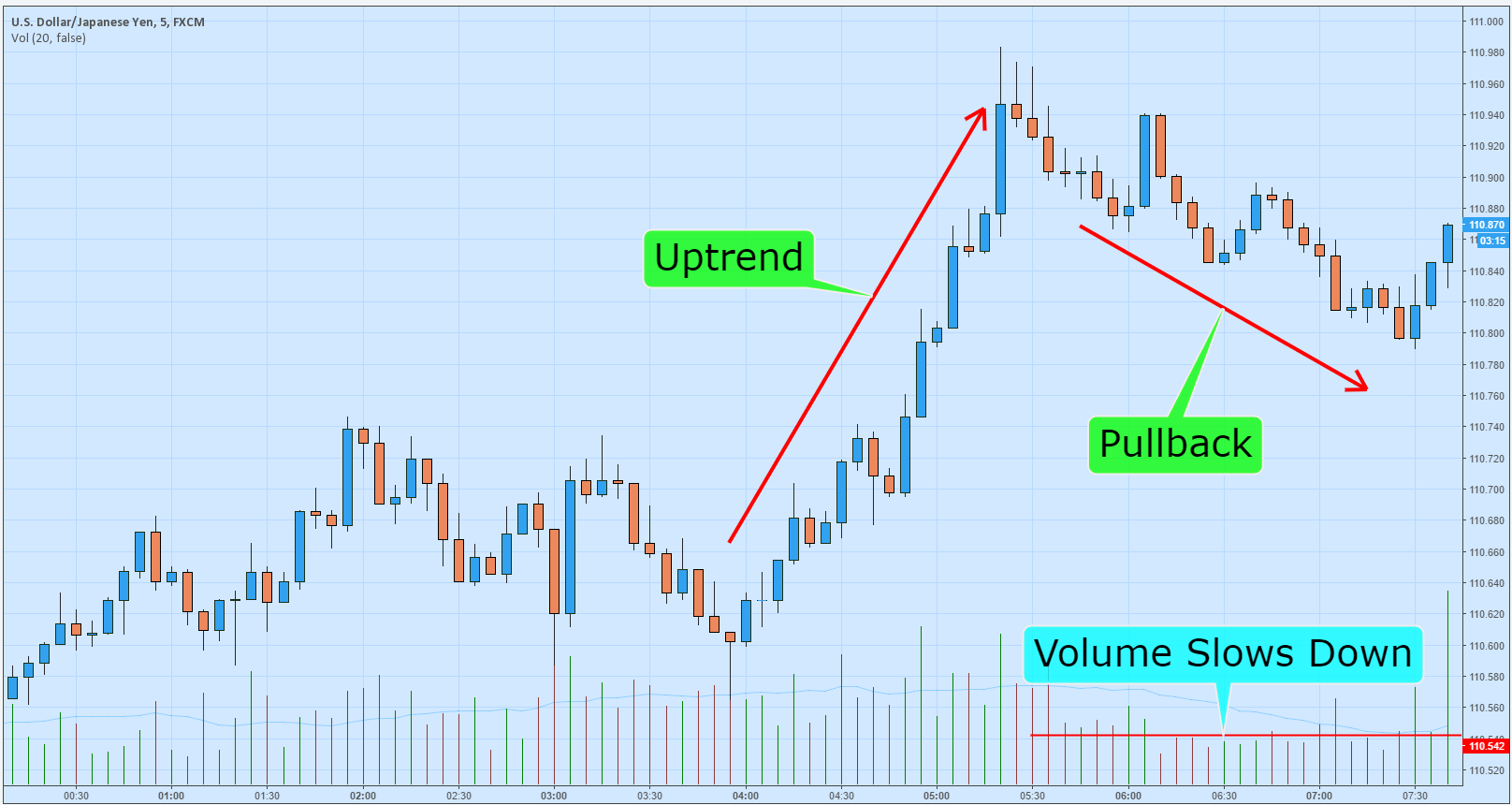

The most popular example of a lagging indicator is a trend. A trend is a zig zag movement that takes the market to highs and lows. A trend is a zig-zag movement because the market never moves in a straight line. Every once in a while, every movement needs to rest to create new momentum. It is impossible for all traders to continue buying.

This is why trends take two steps forward and one step back. The resulting zig-zag movement is easy to identify and allows for accurate predictions.

- Uptrends continue to produce highs and lows.

- The downtrend continues to create lows and lows.

A trend strategy predicts that the current trend is likely to continue.

- When the market is in an uptrend, trend traders invest in rising prices.

- When the market is in a downtrend, trend traders invest in falling prices.

Some traders also trade every swing in the trend. A swing is a movement from a high to a low, and by trading swings during a trend, swing traders hope to increase their profits. Of course, trends don’t last forever. But even with high/low options, you only need to win 60 percent of your trades to make money. A well-executed trend strategy can easily achieve this goal. A trend is a lagging indicator because it tells you where the market is in trend over the past period. Although this knowledge also allows predictions of what will happen next, the main indication of trends is based on past price movements. The trend is also the most important lagging indicator. Most other lagging indicators lose their ability to predict when the market is stationary, which is why trend analysis should precede the use of other technical indicators.

Example 2: Moving average

Another popular example of a lag indicator is the moving average. The moving average calculates the average price of the past period and draws it into your chart. It then repeats the process for all previous periods and connects the dots to a line.

The position and direction of moving averages can tell you a lot about what an asset’s price has done:

- When the moving average moves up, the market must have risen over the last period. When it points down, the market must fall.

- When the market is trading higher than the moving average, the market must have risen in the past period. When the market is trading lower than the moving average, the market must fall.

When these two indications point in the same direction, you have a good indication of what is going on.

- When the market is trading above the moving average and the moving average is pointing up, the market is likely rising.

- When the market is trading below the moving average and the moving average is pointing down, the market may be falling.

These signs help you make better investment decisions.

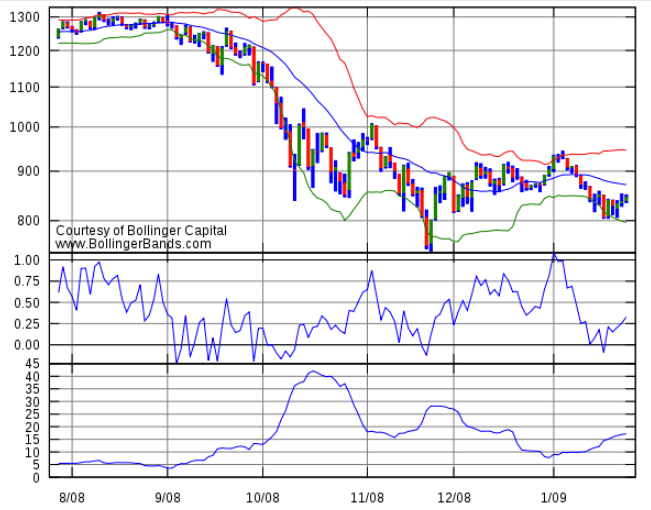

Example 3: Bollinger Bands

Bollinger Bands are popular indicators because they create price channels where the market may remain. This price channel consists of three lines or bands:

- The 20-step moving average is the middle line.

- The top line is two standard deviations above the median line.

- The lower line is two standard deviations below the midline.

The market always never leaves the outer two lines of the Bollinger Bands. The center line serves as resistance or weaker support, depending on whether the market is currently above or below it.

Bollinger Bands can help you understand whether the price of an asset is likely to go up or down.

- When an asset is trading near the top of the Bollinger Bands, it has little room to climb further. As a result, it may fall.

- When an asset is trading near the lower Bollinger Bands range, it has little room left to fall further. Therefore, it will probably increase.

- As the asset approaches the midline, it will likely break. Sometimes, the market will break the center line; sometimes, it will change.

These signs give you many trading opportunities. Bollinger bands are lagging indicators because they only tell you what happened in the past. Moving averages and standard deviations are based on the last 20 periods. While it is likely that the market will follow the same equation for the current period, also, Bollinger Bands cannot predict a trading range 50 periods from now. Then, the market environment will change, and the trading range will be different. Despite these limitations, Bollinger Bands can be an important part of your trading strategy. We will then see how.

Why should I use the Lagging indicator?

Some newcomers to binary options question whether lagging indicators can help them at all. They point out that every trader has to predict what will happen next, and think that an indicator that tells you what has happened is of little help with this task. This merchant is wrong. Lagging indicators can make valuable predictions and help you gain deep insight into the market. There are two main reasons why traders use lagging indicators:

- Lagging indicators based on proven facts; the main clue is not.

- Understanding what has happened helps you predict what will happen next.

Let’s take a closer look at the three advantages of lagging indicators.

Advantage 1: Lagging indicators are based on proven facts, leading indicators are not

When the 50-step moving average is pointing up, you know that the asset’s price has risen more than it has fallen in the last 50 periods. The result is indisputable. Likewise, when the market is trading below the moving average, you know that the market has recently picked up some downward momentum. This knowledge puts your trading strategy on solid footing.

Conservative traders will like lagging indicators because they give them a certain basis from which to make their decisions. The main indicators are different. The number is the main indicator, for example.

The volume strategy predicts that a reduction in volume signals the end of a move. This may be true, but it is not certain, and it is impossible to prove this relationship – you have to believe it. Although volume is slowing, the price movement itself can accelerate. Sometimes, a reduced number indicates an ending movement; sometimes not. In short, lagging indicators focus on past price movements – which are known.

Leading indicators imply that other factors will influence future price movements – you can believe that there is a connection, and there may be, but there are many other factors that affect the market, therefore, it is impossible to say whether this connection affects the market at all and equally there it will affect the market more strongly than other extensions.

Advantage 2: Understanding what has happened helps you predict what will happen next.

Lagging indicators also allow predictions of what will happen next – they only do so indirectly. Leading indicators imply that certain factors will determine where the market will go next. The lagging indicator makes no such assumption. They only predict that what has happened before will continue. When the market crosses the moving average, the lagging indicator only tells you what has happened – the market has recently changed direction. The implicit assumption is that this movement will continue.

- If the market has fallen in the past, it seems likely that the same factors that pushed the market down in the past will also push it down soon.

- If the market has been rising for the past period, it seems likely that the same factors that drove the market in the past will also drive it soon.

Both of these predictions can be traded. In general, binary options trading requires you to understand what is happening now. Because there are so many factors at work right now, it’s impossible to say with absolute certainty. But understanding what has happened is an important part of arriving at a prediction that can be said to be correct in the case of enough to make you money.

How To Change Lagging Indicators

Let’s get concrete. Here are three strategies for how you can trade lagging indicators with binary options.

Strategy 1: Trade Swings In Trend With One Touch Options

Each trend consists of many changes. Every single swing offers a great trading opportunity for a touch option because it combines strong direction and length signals. Every movement in the main trend is followed by a movement in the opposite direction and vice versa. This simple relationship makes predicting market direction easy when you recognize swings. Now, you can only trade this signal with a high/low option, but the swing also allows you to trade a touch option, which offers a higher payout but requires you to predict the length of the move. In a trend, major directional changes will always move at least as far as the extremes.

- In an uptrend, the next swing will reach at least the previous high price level.

- In a downtrend, the next move down will reach at least the previous low price level.

Swinging in the direction of major trends follows the same obvious rules. The market usually reverses one-third or two-thirds of the previous movement in the main trend.

- In an uptrend, the downswing will reverse about one-third to two-thirds of the previous upswing.

- In a downtrend, the upward swing will reverse about one-third to two-thirds of the previous downward movement.

With this knowledge, you get the clear price target you need to trade with one touch of options. Here’s what you do:

- Wait for the swing to end.

- Determine the range and direction of the next swing.

- Check if your broker offers one-touch options with target prices within the range of these movements and realistic expirations. If so, give it to me. If not, trade the option high/low in the direction of that movement.

At this point, it is important to note that movements against the main direction of the trend are usually more volatile and take longer to develop. Many traders avoid trading reversals with one touch options and use high/low options instead. Decide for yourself how you want to trade.

Strategy 2: Trade the Market Crossing a Moving Flat With High / Low Options

When the market crosses the moving average, it appears to change direction. You can predict that this new movement will continue and invest in high / low options in the direction of the movement.

- When the market crosses the moving average down, invest in low options.

- When the market crosses the moving average, invest in high options.

An important aspect of this strategy is that you choose the right expiration. For example, a 9-year moving average cannot predict what will happen to asset prices over the next 50 periods. 50 periods and 9 periods are very different time frames. To avoid making impossible predictions based on your moving average, always have your expiration shorter than the amount of time your moving average is based on.

Ideally, you would use an expiration that is shorter than half of your moving average. Likewise, you should avoid using expirations that are too short, or short-term market volatility may cause you to lose your trade despite making the correct forecast. Use an expiration of at least a quarter of the time that is the basis of your moving average.

For example, when you use a moving average that is based on 20 periods and a price chart with a period of 5 minutes, your moving average is based on 100 minutes (20 times 5). Ideally, you would trade these moving averages with expirations of 25 to 50 minutes. You can also go a little longer or shorter, but a 60 second expiration would be too short and one of 4 hours would be too long.

Strategy 3: Trade Bollinger Bands With Low-Risk Field Options

Bollinger Bands show the market’s trading range, and the ladder option allows you to predict which prices are outside the market’s range – it’s a great combination. The success of this strategy also depends on choosing the right expiration. Bollinger Bands are lagging indicators, which is why they cannot predict what will happen ten periods down the road. At that time, the market will change, and the Bollinger Band indicator will change with it.

To ensure that the Bollinger Bands in your chart make valid predictions for your options, you need to set your chart period to the same value as your expiration or longer. The important thing is that your option expires in this period because Bollinger Bands only make predictions for this period. When you think about trading options with 15-minute expiration, you need to use at least a 15-minute chart.

If ten minutes have passed in the current period, you need to switch to the 30-minute chart to ensure that your option expires in the current period. All you need to do to implement this strategy is:

- Set the duration of your char until your expiration.

- Analyze the upper and lower price ranges of your Bollinger Bands.

- Look for ladder options with target prices outside these boundaries.

- Predict that the market cannot reach this price level.

For example, assume that an asset is trading for £100. The upper Bollinger Band is £101, and the lower band is at £99.5. Your chart expiration and duration is 30 minutes, and there is no time elapsed in the current period.

- If your broker offers a ladder option with a target price of £101.5, you know that the target price is outside the range of the Bollinger Bands. Therefore, you should invest in low options based on this target price, and thus predict that the market cannot reach this price level.

- If your broker offers a ladder option with a target price of £100.5, you know that the target price is within the Bollinger Bands range. This target price would be a bad investment based on this strategy.

With this strategy, you will get relatively low payouts. Since you should be able to win the majority of your trades, you should be able to make consistent profits.

Summary

Lagging indicators are an important aspect of any market analysis strategy. They offer certain indications of what has happened and enable quality predictions of what will happen next. Strategies based on trends, moving averages, and Bollinger bands have helped many traders create successful trading strategies.

Three Examples of Strategies For Technical Indicators

To help you get started with binary options and technical indicators, here are three examples of strategies you can use.

One: Trade Extreme MFI / RSI

Money Flow Index (MFI) and Relative Strength Index (RSI) are easy to interpret technical indicators based on the same idea. Both indicators are oscillators, and both calculate the strength of a move by relating current momentum to past momentum. The difference is that the MFI also considers volume while the RSI focuses on price action only. Choose the indicator you like better; it will make little difference to your final strategy. Both LKM and RSI determine the buying advantage and selling width.

- When a trader has bought an asset for too long, the MFI and RSI assume that there are not enough buyers left in the market to continue driving the price. The market is overbought and a possible recovery.

- When a trader has sold an asset for too long, the MFI and RSI assume that there are not enough sellers left in the market to continue driving the price down. The market is oversold and a possible recovery.

Based on this simple prediction, you can trade binary options. When your chosen indicator reaches an extreme value, invest in the opposite direction and predict that the market will change soon. Some traders also invest when the market leaves the extreme area, saying that it is better to invest in a reversal that has already occurred (as indicated by the market leaving the extreme area) than an imminent recovery (as indicated by the market entering the extreme area) . Some traders also wait a few periods before they invest and see if the market is still in extreme territory.

Two: Trading Bollinger Bands

Bollinger Bands are a great technical indicator for binary options traders because they clearly show the price level at which you should expect price action. Bollinger Bands create a price channel consisting of three lines. They are:

- Moving average. The middle line of Bollinger bands is a moving average, usually based on 20 periods.

- Top row. By adding twice the standard deviation to the moving average, Bollinger bands create an upper line.

- Lower row. By subtracting two standard deviations from the moving average, Bollinger bands create a bottom line.

The result of this process is a price channel that surrounds the current market price. Each line serves as resistance or support, depending on the direction from which the market approaches the line.

- When the price approaches the line from above, it acts as a support .

- When the price approaches the line from below, it acts as a resistance .

Traders can trade this line in two ways:

- An impending recovery trade. When the market reaches the line, it will most likely be forced to reverse, at least briefly. Traders can trade this forecast and invest in a move in the opposite direction of the previous move. If you use a high/low option, remember that this is a short-term forecast and use a long expiration of one period. You can also use an optional touch. In this case, make sure you use a target price no more than half the distance to the next line.

- The market trades past the center line. The middle line is special because it can act as resistance or support, depending on the current position of the market in relation to the line. When the market breaks the line, it changes meaning. What resistance is now support, or vice versa. Traders can profit from this milestone and invest in binary options towards discovery.

This easy way to make money is perfect for newcomers. Experienced traders can also add other indicators to confirm the predictions made by Bollinger bands, for example moving averages.

3. Trade Average True Range (ATR)

Flat Universal Range (ATR) is a technical indicator suitable for frontier option traders. Border options are a special type of binary option because they are the only type that do not require you to predict the direction of the market, which is ideal for traders who find this type of prediction difficult. Boundary options specify two target prices in equal distance from the current market price. One above the current market price, one below it. Two win your choice; the market has to trigger either the target price before your option expires.

There is no need to stay at the price level, and only need to touch one target price. A border option is a touch option with two target prices. With frontier options, your job is not to predict which way the market will move. Your job is to predict whether it will move far enough to reach one of the two target prices. ATR is the perfect indicator to make this prediction. ATR does one simple thing: it calculates the average range of past market periods.

If the ATR has a value of 10 and you look at a chart with a period of 10 minutes, for example, the asset has moved, on average, 10 points every 10 minutes in the past. You can adjust the number of periods you want to analyze ATR. Most traders use a 14-period setting, which means that ATR calculates the average range of the last 14 charts in your chart. To trade limit options based on ATR, you just need to compare the ATR reading with the target price.

Let’s go back to our previous example: in a chart with a period of 10 minutes, the ATR has a value of 10. If your broker offers you an option with a target price that is 30 pips away and expires one hour, you know that there is a good chance that the market will reach the wrong a target price. Your thoughts will look like this:

- The market has moved 10 points per period.

- To reach the target price in a straight movement, the market needs to move 5 points per period. The option has expired in 60 minutes and you are looking at a 10 minute chart, this means you have six periods until your option expires. The price target is 30 points away. Divided by six periods, you get the market must move an average of 5 points per period to get the market price in a straight line.)

- The average movement of the market per period is twice as high as the movement required to reach the target price.

- Generally, the market will not move in a straight line, but if it moves in the same direction for two consecutive periods, it is almost there. So there is a good chance that it will reach the target price.

As you can see from this example, you will always need to subtract the maximum reach of the market. If the market moves in the same direction for 60 minutes, it will have 60 points. This will not happen, which is why many traders use discount factors.

They multiply the maximum range by 0.5, for example, and when the target price of the frontier option is closer than the result of this equation, they invest. You can choose the discount factor according to your risk tolerance and experience. We recommend using a factor of 0.5 or lower. A higher factor is too risky. Also, consider the payout you get for your choice.

Some brokers offer high-risk border options (distant target price, higher payouts) and low-risk border options (near target price, lower payouts). Higher payouts allow you to trade profitably when you win fewer trades, which is why you can take more risk and use a higher discount factor.

Some traders also use the moving average directional index (ADX). The ADX shows the strength of the trend on a scale of 0 to 100. 0 indicates a complete lack of direction, 100 that all points point in the same direction. You can calculate your discount factor by dividing the ADX value by 100.

- When the ADX reads 40, you apply a discount factor of 0.4.

- When the ADX reads 70, you use a discount factor of 0.7.

With this strategy, you adjust your discount factor to the current market environment.

Final Word On Technical Indicators

Technical indicators and binary options are a great combination. Technical indicators allow you to make short-term predictions in any market; Binary options allow you to trade these predictions more profitably than other types of trading. For example MFI / RSI, Bollinger bands, or ATR plans, there are indicators for any strategy. Find the right indicator for you, and you have taken a big step towards becoming a successful trader.

If you still need a broker with whom you can trade binary options, check out our top list of the best brokers;