Looking for the best volume trading strategy? Your hunt for the Holy Grail is over. With a win rate of 77%, this could be one of the best Forex trading strategies you’ll find on the internet… and it’s completely FREE.

With more than 30 years of combined trading experience, our team at Trading Strategy Trader has put together this step-by-step trading guide so you can take advantage of analyzing trend strength based on volume activity.

The Forex market, like any other market, requires volume to move from one price level to another.

The Forex market is the largest and most liquid market in the world, with 6 trillion dollars worth of transactions done every day. If you can master volume analysis, many new trading opportunities can appear.

When we have a lot of activity and volume in the market, as a result, it produces large fluctuations and moves in the market. That’s what most traders need to make a profit trading the Forex market or any other market whether it’s stocks, bonds or even cryptocurrencies.

Although you can still make money even in tight range markets, most trading strategies require additional volume and volatility to work.

Forex Indicator Volume

In the Forex market, we do not have a centralized volume exchange because we trade over the counter. If we look at any trading platform like TradingView, they have amounts attached to their charts. But, because we don’t have a centralized exchange the amount comes from the feed that TradingView uses. Each retail Forex broker will have their own aggregate trading volume.

We can see that the trading volume in the Forex market is segmented, which is the reason why we need to use our best volume indicator.

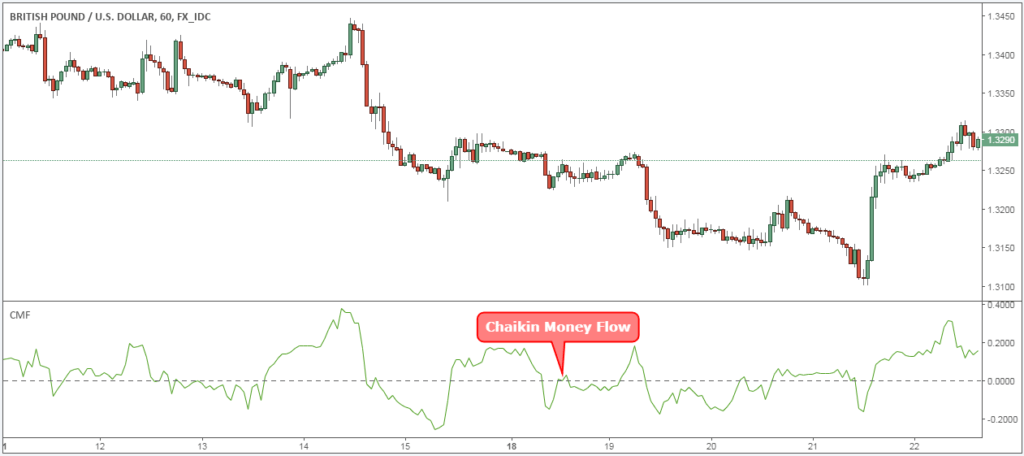

The Forex Volume Indicator used to read volume in the Forex market is the Chaikin Money Flow (CMF) indicator.

The Chaikin Money flow indicator was developed by trading guru Marc Chaikin, who was trained by the world’s most successful institutional investors.

Chaikin’s Money Flow Reason is the best and classic volume indicator that measures the distribution of institutional accumulation.

Usually at rallies, the Chaikin volume indicator should be above the zero line. On the other hand, on sales, the Chaikin volume indicator should be below the zero line.

Volume Trading Strategy

This volume trading strategy uses two very powerful techniques that you won’t see written anywhere else. This is a trading secret that we only teach professional traders.

The Chaikin indicator will dramatically improve your timing and teach you how to trade defensively. Having a good defense when trading is really important to keep the profits you have made.

Before we go any further, we always recommend taking a piece of paper and a pen and taking notes on this method of participation. You can also read a million USD forex strategy

Importance of Buy Volume and Sell Volume

Volume trading requires you to pay close attention to the requested supply power.

Volume traders will look for instances of bullish buys or sell orders. They also pay attention to current price trends and potential price movements.

Generally, increased trading volume will lean heavily on buy orders. This positive volume trend will encourage traders to open new positions.

On the other hand, if cash flow and trading volume are declining – we see a “decline divergence”, which means it may be a good time to sell.

You also need to pay attention to the relative volume – regardless of the amount of raw transactions that occurred during the trading period. Ask yourself how the asset will be affordable compared to what is expected?

By learning how to use Chaikin’s money flow and other related indicators, you can easily identify whether buyers or sellers are “in control.”

With practice, volume trading strategies can produce wins for your portfolio 77% of the time!

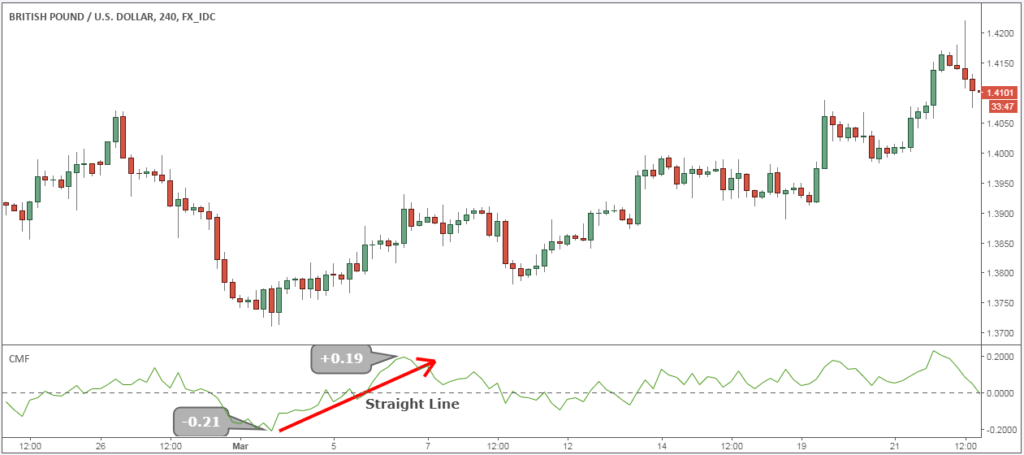

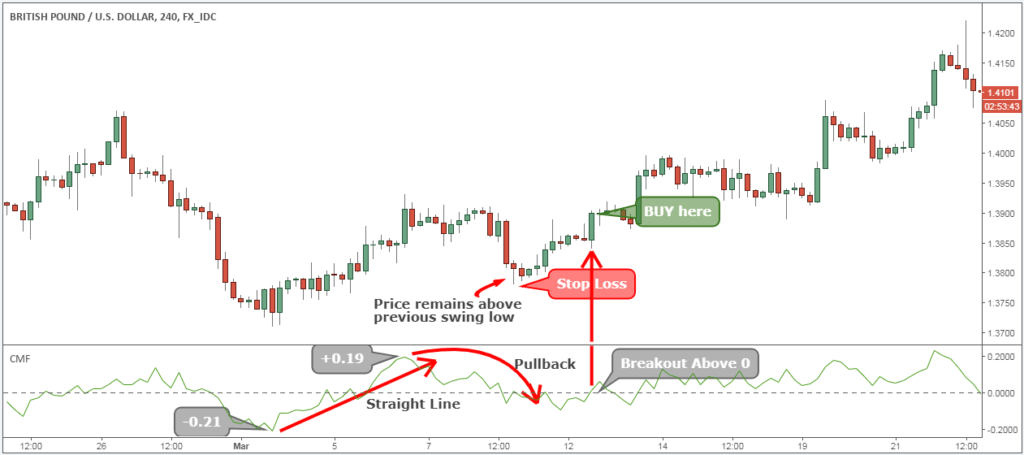

Step #1: The Chaikin Volume Indicator must shoot in a straight line from below zero (minimum -0.15) to above the zero line (minimum +0.15).

When Volume goes from negative to positive in a strong fashion it has the potential to signal strong institutional buying power. That’s the basis of our heavy signal lifting!

Basically, we let the market reveal its intentions.

When big money steps into the market, they leave a mark because their orders are so large that they are impossible to hide. When the Forex volume indicator moves straight from below zero to above the zero line and beyond, it indicates accumulation of smart money.

We firmly believe that you get maximum bang for your buck when you trade side by side with smart money. Institutions likely have more money and more resources at their disposal. Confusion can be stacked against you, so if you want to change it, just follow the smart money.

There is one more condition that needs to be met to confirm trade entry.

See below:

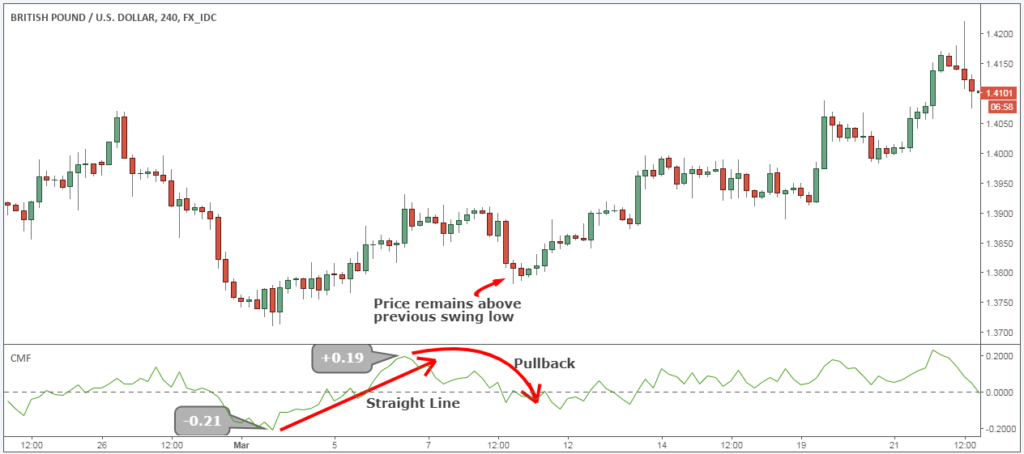

Step #2: Wait for the Forex Volume Indicator to slowly retreat below the zero line. Price should remain above the previous swing low.

Once we see the elephant in the room, aka institutional players, we start looking for the first signs of market weakness. Here’s how to recognize the right swings to increase your profits.

We will let the Wang Chaikin trend indicator slowly fall below the zero line. The key word here is “slowly”. We don’t want to see the volume drop as this will cancel the pooling mentioned earlier.

Second, when the volume drops and drops below zero, we want to make sure the price stays above the previous swing light. This will confirm the accumulation of smart money.

The Volume Strategy meets all the necessary trading conditions, which means that we can move forward and outline what the trigger conditions are for our entry strategy.

See below:

Step #3: Buy once the Forex Chaikin indicator breaks above the zero line. Wait for the candle to close before pulling the trigger.

Now that we have seen real institutional money coming into the market, we are waiting for them to step in and drive the market back.

When the Chaikin indicator peaks above zero, it signals an almost certain rally as the smart money tries to mark price again.

We need to wait for the close candle to confirm that Chaikin breaks above the zero line. When everything is aligned, we are free to open our old positions. Here is an example of a master candle setup.

* Note: The candle trigger must have a closing price above 25%.

This brings us to the next important step. We need to establish a Chaikin trading strategy that finds where to place our protective stop loss.

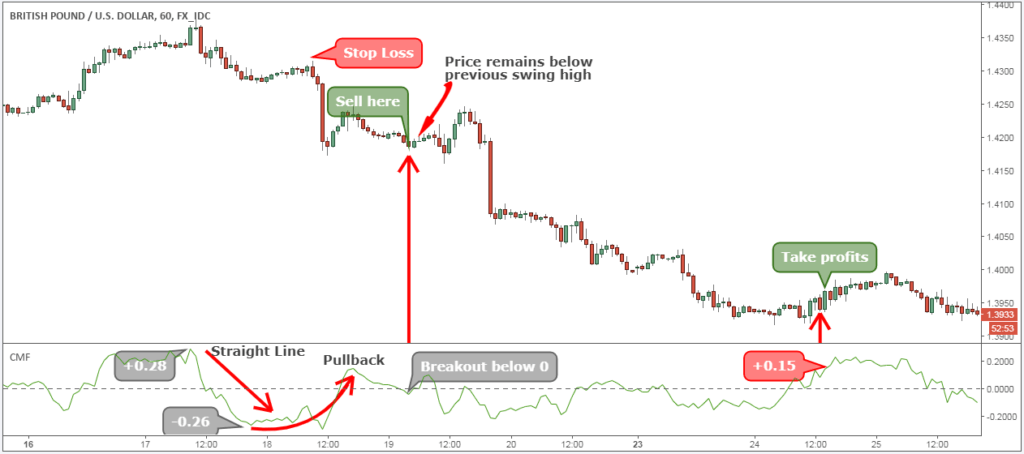

Step #4: Hide your protective Stop Loss below the previous retracement level

Using stop loss is important if you want to know about how much loss you will face on your trade. Never underestimate the power of placing a stop loss because it can save lives.

Just keep your protective stop loss below the previous price drop. Never use a mental stop loss, and always do SL right the moment you open your trade.

Trading with a tight stop loss can give you the opportunity to not only have a better risk to reward, but also to trade larger sizes.

Finally, we also need to learn how to maximize your profits with the Chaikin trading strategy.

See below:

Step #5: Take profit when the Chaikin Volume drops below -0.15

When the Chaikin volume drops back below -0.15, it indicates that sellers are stepping in and we want to take profits. We don’t want to risk giving back some of the gains made so we liquidate our positions at the first sign of smart money stepping across the market.

We can always come back to the market later if smart money buyers show up again.

** Note: Above is an example of a BUY trade using the best volume indicator. Use the same rules for SELL trades – but in reverse. In the picture below, you can see an example of a real SELL trade.

Conclusion – Best Volume Indicator

The Volume Trading Strategy will continue to work in the future because it is based on how the market moves up and down. Any market moves from accumulation (distribution) or base to runaway and so on. This is how the market has moved for over 100 years.

Smart money always tries to cover up their trading activities, but their footprints are still visible. We can read the sign by using the appropriate tool. Here is another strategy on how to apply technical analysis step by step.

Make sure you follow this step-by-step guide to correctly read Forex trading volumes. The Chaikin indicator will add additional value to your trades because you now have a window into volume activity in the same way as when you trade stocks.