Strategy

A day trading strategy is essential when you want to take advantage of frequent and small price movements. A consistent and effective strategy relies on deep technical analysis, using charts, indicators and patterns to predict future price movements. This site will give you comprehensive beginner strategies, work up to advanced strategies, automation and specific assets.

It will also outline some regional differences to be aware of, as well as point you towards some useful resources. However, you need to find a day trading strategy that suits your specific trading style and needs.

Also, make sure you choose a trading based broker strategy based on the trading day. You will want things like;

- Excellent trade execution speed,

- Price action data (+ Level 2 if possible)

- Ability to trade directly from the graph,

- Trade automation,

- Stop loss and take profit order

- Etc.

Visit the broker’s page to make sure you have the right trading partner at your broker.

Trading Strategies for Beginners

Before you get stuck in the complex world of technical indicators, focus on the basics of a simple day trading strategy. Many make the mistake of thinking you need a very complicated strategy to succeed in intraday, but often simpler, more effective.

The Basics

Incorporate the invaluable elements below into your strategy.

- Money management – Before you start, sit down and decide how much you’re willing to risk. Remember most successful traders will never put more than 2% of their capital on the line per trade. You have to prepare yourself for some losses if you want to be around when the winning starts.

- Time management – Don’t expect to make a fortune if you only spend an hour or two a day trading. You need to keep an eye on the market and look for trading opportunities.

- Start small – As you find your feet, stick to a maximum of three stocks a day. It is better to get a good response from some than to be average and not make money for loads.

- Education – Understanding the complexities of the market is not enough, you also need to stay informed. Make sure you stay up to date with market news and any events that will affect your assets, such as shifts in economic policy. You can find financial and business resources online that will let you know.

- Consistency – It’s harder than it looks to maintain emotion when you’ve had five coffees and you’ve been staring at a screen for hours. You have to let your math, logic and strategy guide you, not nerves, fear, or greed.

- Timing – The market will be volatile when it opens each day and while experienced day traders may be able to read patterns and profit, you should be wasting your time. So hold on for the first 15 minutes, you still get an hour ahead.

- Demo Account – A must-have tool for beginners, but also a great place to make suggestions or experiment with new or refined strategies for advanced traders. Many demo accounts are unlimited, so there is no time limit.

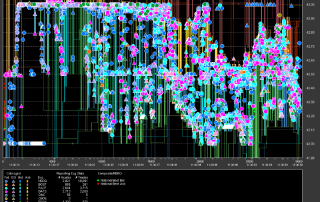

Components Every Strategy Needs

Whether you are after an automated day trading strategy, or beginner and advanced tactics, you need to consider three important components; volatility, liquidity and volume. If you’re making money with small price movements, picking the right stocks is important. These three elements will help you make that decision.

- Liquidity – This allows you to get in and out quickly at attractive and stable prices. A liquid commodity strategy, for example, will focus on gold, crude oil and natural gas.

- Volatility – This tells you your profit potential. The greater the volatility, the greater profit or loss you can make. The cryptocurrency market is one well-known example of high volatility.

- Volume – This measurement will tell you how many times a stock / asset has been traded in a given time period. For today’s traders, this is better known as the ‘average daily trading average.’ High volume tells you there is significant interest in an asset or security. An increase in volume often jumps the price indicator either up or down, quickly approaching.

5 Day Trading Strategies

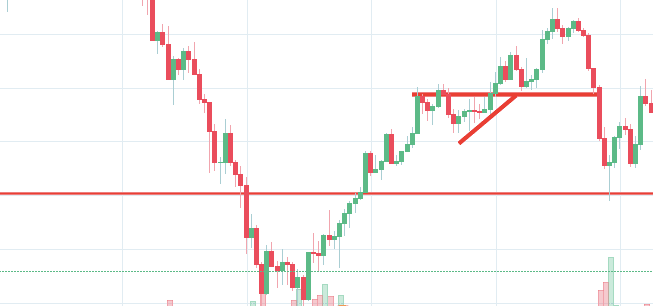

1. Breakout

Breakout strategies are centered around when price clears a certain level on your chart, with increasing volume. A shooting trader enters a long position after the asset or security breaks above resistance. Alternatively, you enter a short position when the stock breaks below support.

After an asset or security trades above a stated price barrier, volatility typically increases and prices will often change direction in a breakout direction.

You need to find the right instrument to trade. When doing this keep in mind the asset’s support and resistance levels. The more often prices have hit these things, the more confirmed and important they become.

Entrance

This part is nice and easy. The price set to close and raise the resistance level requires a bearish position. A price set to close and below a support level requires a bullish position.

Plan your exit

Use the asset’s recent performance to establish a reasonable price target. Using chart patterns will make this process more accurate. You can calculate the average of recent price changes to create a target. If the average price swing has been 3 points over the last few price changes, this would be a reasonable target. Once you achieve that goal, you can exit the trade and enjoy the profits.

2. Scalping

One of the most popular strategies is scalping. It is very popular in the forex market, and it seems to take advantage of the mean price changes. The driving force is quantity. You will look to sell as soon as the trade becomes profitable. This is a fast and exciting way to trade, but it can be risky. You need a high trade probability to ignore the low risk and reward ratio.

Be careful with volatile instruments, liquidity that is attractive and hot at times. You can’t wait for the market, you need to close the losing trade as soon as possible.

3. Momentum

Popular among trading strategies for beginners, this strategy revolves around acting on news sources and identifying large trend moves with high volume support. There is usually at least one stock that moves around 20-30% daily, so there is ample opportunity. You just hold your position until you see signs of a reversal and then exit.

Alternatively, you can trim the price drop. This way, your price target is as soon as the trading volume starts to decrease.

This strategy is simple and effective if used correctly. However, you must make sure you are aware of upcoming news and earnings announcements. Just a few seconds on each trade will make all the difference to your final profit.

4. Reversal

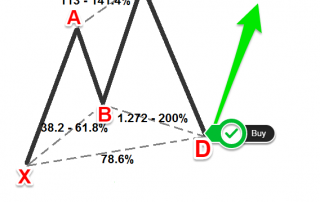

Although hotly debated and potentially dangerous when used by beginners, reverse trading is used worldwide. It is also known as trend trading, retracing trends and meaningful reversal strategies.

This strategy defies basic logic when you intend to trade with the trend. You need to be able to identify possible pullbacks, and predict their strength. To do this effectively, you need deep market knowledge and experience.

The ‘daily pivot’ strategy is considered a unique case of reversal trading, as it focuses on buying and selling the daily lows/reversals of highs and lows.

5. Using Pivot Points

Day trading point pivot point strategies can be great for identifying and acting on critical support and/or resistance levels. It is very useful in the forex market. In addition, it can be used by multi-bound traders to identify entry points, while traders and cruise traders can use pivot points to find key levels that need to be broken to move to count as breakouts.

Calculating Pivot Points

A pivot point is defined as a point of rotation. You use the previous day’s high and low price, plus the closing price of the security to calculate the pivot point.

Note that if you calculate a pivot point using price information from a relatively short time period, accuracy is often reduced.

So, how do you calculate the pivot point?

- Center Pivot Point (P) = (High + Low + Close) / 3

You can then calculate support and resistance levels using pivot points. To do that, you need to use the following formula:

- First Resistance (R1) = (2 * P) – Low

- First Support (S1) = (2 * P) – High

Second support and resistance levels are then calculated as follows:

- Second Resistance (R2) = P + (R1-S1)

- Second Support (S2) = P – (R1- S1)

Application

When applied to the FX market, for example, you will find that the trading range for the session often occurs between the pivot point and the first support and resistance levels. This is because many traders play this range.

It’s also worth noting, this is one system & method that can be used for indexes as well. For example, it can help form an effective S&P day trading strategy.

Limit Your Losses

This is especially important if you use margin. The requirements are usually high for day traders. When you trade on margin you are increasingly exposed to sharp price movements. Yes, this means the potential for greater profits, but it also means the possibility of large losses. Fortunately, you can use a stop loss.

Stop-loss controls your risk for you. In short positions you can place the stop loss above the recent high, for long positions you can place it below the recent low. You can also make it dependent on volatility.

For example, the share price moves by £0.05 per minute, so you place a stop loss of £0.15 from your entry order, allowing it to wing (hopefully in the expected direction).

A popular strategy is to set up two stop losses. First, you physically place a stop loss order at a certain price level. This will be the most capital you can afford to lose. Second, you make a mental stop loss. This place at the point where your entry criteria is violated. Therefore, if the trade takes an unexpected turn, you will make a quick exit.

Forex Trading Strategies

Forex strategies are inherently risky because you need to accumulate your profits in a short space of time. You can use any of the above strategies for the forex market, or you can see our forex page for detailed strategy examples.

Cryptocurrency Trading Strategies

The exciting and volatile cryptocurrency market offers many opportunities for traders today. You don’t need to understand the complex technical makeup of bitcoin or ethereum, and don’t need to hold a long-term view of their viability. Just use simple strategies to profit from this volatile market.

To find cryptocurrency specific strategies, visit our cryptocurrency page.

Stock Trading Strategies

Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined above. Below though are specific strategies you can use for the stock market.

Moving Average Crossover

You need three moving average lines:

- A set of 20 periods – This is your fast moving average

- One set at 60 periods – This is your slow moving average

- A set at 100 periods – This is your trend indicator

This is one of the moving average strategies that generates a buy signal when the fast moving average crosses and moves towards the slow moving average. A sell signal is generated only when the fast moving average crosses the slow moving average.

So, you will open a position when the moving average line crosses in one direction and you will close a position when it crosses the opposite way.

How do you establish a sure trend? You know the trend is happening if the price bar stays above or below the 100-period line.

For more information on stock strategies, see our Stocks and shares page.

Spread Betting Strategies

Spread betting allows you to speculate on a large number of global markets without ever owning the asset. Plus, the strategy is quite simple.

If you want to see some of the best trading strategies today, check out our betting page.

CFD Strategies

Developing an effective day trading strategy can be complicated. However, choosing a tool like CFD and your task may be quite simple.

CFDs concern the difference in which trades are entered and exited. Recent years have seen a wave of their popularity. This is because you can profit when the underlying asset moves in relation to the position taken, without having to own the underlying asset.

For CFD day trading tips and strategies, check out our CFD page.

Regional Differences

Different markets come with different opportunities and obstacles to overcome. Day trading strategies for the Indian market may not work when you use them in Australia. For example, some countries may not believe the news, so markets may not react the same way you would expect them to back home.

Regulations are another factor to consider. Indian strategies may be tailored to fit certain rules, such as high minimum equity balances in margin accounts. So, get online and check the unclear rules won’t affect your strategy before you put your hard earned money away.

You may also find that different countries have different tax loopholes to jump through. If you are based in the West but want to use your normal day trading strategy in the Philippines, you need to do your homework first.

What type of tax do you have to pay? Do you have to pay it abroad and/or domestically? Marginal tax inequality can have a big impact on your bottom line.

Risk Management

Stop-loss

A strategy that works takes risk into account. If you don’t manage risk, you’ll lose more than you can afford and be out of the game before you know it. This is why you should always use a stop-loss.

The price may look like it is moving in the direction you expect, but it can reverse at any time. Stop-loss will control that risk. You will exit the trade and incur only minimal losses if the asset or security does not come through.

Savvy traders usually don’t risk more than 1% of their account balance in a single trade. So if you have £27,500 in your account, you can risk up to £275 per trade.

Position size

It will also allow you to choose the perfect position size. Position size is the number of shares taken on one trade. Take the difference between the entry price and your stop loss. For example, if your entry point is £12 and your stop loss is £11.80, then your risk is £0.20 per share.

Now to find out how many trades you can take in one trade, divide £275 by £0.20. You can take a position size of up to 1,375 shares. That’s the maximum position you can take to stick to your 1% risk exposure.

Also, check there is sufficient amount in stock/assets to absorb the size of the position you are using. In addition, keep in mind that if you take a position size that is too large for the market, you may face a downside to your entries and stops.

Learning Methods

Everyone learns in different ways. For example, some will find day trading strategy videos most useful. This is why a number of brokers now offer a wide variety of day trading strategies in easy-to-follow training videos. Head to the learning and resources section to see what’s on offer.

Blogs

If you are looking for the best day trading strategies that work, sometimes online blogs are the place to go. Often free, you can learn in day strategies and more from experienced traders.

In addition, you will find that they are aimed at traders of all experience levels. So you can find beginner PDF and advanced PDF. You can also find country specific options, such as daily trading tips and strategies for India PDF.

Books

Having said that, PDFs won’t go into the level of detail that many books will. The books below offer examples of detailed intraday strategies. Easy to follow and understand also makes them suitable for beginners.

- Simple Strategies – Mature Day Trading Strategies for Trading Futures, Stocks, ETFs and Forex, Mark Hodge

- How to Day Trade: The Ultimate Guide to Day Trading Strategies, Risk Management, and Psychological Traders, Ross Cameron

- Intra-Day Trading Strategy: Proven Steps to Profitable Trading, Jeff Cooper

- The Complete Guide to Day Trading: A Practical Guide from Professional Day Trading Coach, Markus Heitkoetter

- Stock Trading Wizard: Detailed Short-Term Trading Strategies, Tony Oz

Therefore, day trading strategy books and ebooks can help improve your trading performance seriously. If you want more reading, check out our books page.

Online Courses

Others will find interactive and structured courses the best way to learn. Fortunately, there are now various places online that offer such services. You can find courses on day trading strategies for commodities, where you can walk through crude oil strategies. Alternatively, you can find FTSE day trading strategies, gaps, and day hedging.

Trading For A Living

If you are looking to quit your day job and start day trading for a living, then you have a challenging but exciting journey ahead of you. You need to wrap your head around advanced strategies, as well as effective risk and money management strategies. Discipline and holding on to your emotions is important.

For more information, visit our ‘trading for a living’ page.

Final Word

Your final profit will depend on the strategy you use. So, it is worth remembering that it is often a simple strategy that proves successful, regardless of whether you are interested in gold or the NSE.

Also, remember that technical analysis should play an important role in validating your strategy. In addition, even if you choose to enter early or end of day trading strategies, controlling your risk is important if you still have cash in the bank at the end of the week. Finally, developing a strategy that works for you takes practice, so be patient.