Learn how to trade the London breakout strategy and some effective ways to beat the smart money. We bring you day trading strategies that our London traders have successfully used. The London breakout trading strategy incorporates secret trading concepts that you can take advantage of in the Forex market.

If this is your first time on our website, our team at Trading Strategy Traders welcomes you. Make sure you hit the subscribe button, so you get your Free Trading Strategy every week straight into your email box.

Everyone has heard of runaway trading. As the term implies, breakout trading strategies attempt to identify price movements that “break” out of a predictable range. These ranges can be captured through Bollinger Bands and various other technical indicators.

In fact, tracking is one of the most popular trading strategies out there.

Market prices (whether for Forex currencies, futures, stocks, commodities or cryptocurrencies) constantly change from trend to range and vice versa.

And the only way a transition from a range to a trend can happen is if the price breaks the range.

Throughout this trading guide, you will learn about specific breakouts aka London open breakout strategies.

We will reveal some trading secrets to help you implement the opening distance disposal technique in your own trading.

First, let me explain what London’s open strategy is.

What is the London Breakout Strategy?

In a nutshell, the London Breakout 2020 strategy is a day trading strategy that aims to take advantage of the trading range before the London opening session.

Because London is in a different time zone, the market opens several hours before the exchange in New York. This gives traders an opportunity to enter new positions.

Among retail traders, this is also known as the London day release strategy.

Day trading open strategies are simply:

- Taking a position well above the London trading range

- Taking a short position below the London trading range

Basically, today’s trading strategy will teach you how to trade in London.

London’s escape strategy has been around for decades.

Smart money uses the London Forex session to benefit from predictable breakout signals.

Nowadays, the secret has been revealed to the public.

However, retailers are still left in the dark.

To successfully trade the London open day, you need to understand how the price of a security is determined.

The truth about trading is that you need the right approach to implement a trading strategy.

So, what can you do?

First things first, keep reading the London trading guide.

Our team of industry experts will reveal the missing link to successfully trading the London opening network breakout strategy.

But, first, let’s learn how to determine the London trading range.

Let’s start!

How to Determine the London Trading Range

We will look at 2 methods to determine the London trading range.

The most basic form of establishing London tiles is to use the high and low of the previous trading session aka the Asian trading session.

This method takes into account the entire price action since the start of a new trading day.

The advantage that comes with this approach is that it will help you manage your trades better.

The second method is used to determine that the London trading range ignores that stick candle and focuses on the closing price to determine the range.

Note * This trading technique works best when used in conjunction with Asian currencies such as USD / JPY.

This is an unconventional method that has its own merits.

Let me explain…

Most of the trading volume takes place in the body of the candle. Therefore, by ignoring the axes, we remain focused on where the real action takes place.

I’m sure no one told you this!

But, there are great advantages that come with it.

That is, you will avoid false penetration and secondly, you will enter the market early with the big boys.

Now that we’ve covered how to determine the London trading range let’s look at some of the reasons why the London open is such a powerful tool.

This will give you more confidence in your trading.

When self-doubt and doubt take over your trading mind, you will fail as a trader.

So, let’s get it over with.

See below:

Why London’s Open Escape Strategy Works

When London opens at 8:00am GMT, you tend to see a lot of early volatility.

That is the case with almost all major financial centers around the world, but more specifically with open London and New York. Both trading sessions tend to see the most trading volume.

For more information on Forex trading sessions, please refer to our Forex Beginners guide.

Around this time, major banks and financial institutions begin their day.

Everyone has their own needs.

Let me explain…

Much of the trading activity will come from banks, which will try to accommodate their corporate clients.

Therefore, it is inevitable that trading at the London open or the New York open will bring you more volatility.

In other words, this is your main window for making money trades.

Because volatility is synonymous with more trading opportunities.

Most trading activity will be compressed in this time frame. If you miss your entry and the trend emerges from the opening breakout in London, the market doesn’t give you a second chance to get back into the trend.

That is why the London forex conversion strategy is so powerful.

Be sure to monitor the first hour after the London trading session opens.

If you want to beat the market with smart money, that’s a good starting point.

Our expert team has done a very rigorous London cruise strategy backtest and found the perfect time window to make money forex trading. Make sure you act quickly because the window of opportunity is very limited.

When to Trade the London Open Strategy

The ideal time window to trade the London open strategy is one hour before the open and one hour after the London open. Basically, you have a trading opportunity of 2 hours.

You only need to be in front of the chart from 7:00 AM to 8:00 AM GMT and from 8:00 AM to 9:00 GM.

Our backtesting results have revealed that 1 hour before the London open has the same correlation as 1 hour after the London open

Most times the fluctuations will start taking 30 minutes before the real London opens.

In fact, our favorite London trading setup to trade is when the market starts to move before the London open.

There are many ways to heal a cat, but you need a proven method to rely on, otherwise you’re just guessing.

As we are about to prove to you, our London escape prep has an edge.

As we are about to prove to you, our London escape prep has an edge.

The foundation of trading to trade profitably London’s eradication strategy is to trade with people.

After all, it is a known fact that 95% of all traders lose money.

This statistic has been around for years.

So, what can you do to avoid becoming part of those statistics?

Just follow our London open breakout trading rules and become part of the elite 5% of traders who make money consistently.

See below:

How to Launch a Lonon Breakout Strategy

We trade the London breakout strategy by fading the pre-open move.

The results of our backtesting revealed that with the downside of the London Open, we have a very high probability trade setup.

Now there is a catch to this.

You have to follow some strict trading rules for long distance runs.

We will not trade every day, but only when the market quote is in hand and confirms all our rules.

If not, we can save money to fight another day.

Here’s how you can trade in London with smart money.

See below:

Rule #1 Determine the London Trading Range

We will use a distance definition that takes into account only the candle body, excluding the wicks.

Note * these trading rules can be customized as you gain more experience reading price action.

Who knows, maybe you’ll be able to spot some price action trends around the London open that people can’t see.

In the GBP/USD chart below, we have outlined the trading range:

The London open breakout strategy works because the Asian trading range tends to attract buying and selling interest above and below the trading range.

Most buying and selling stops are easy targets for smart money.

Remember that traders need liquidity to execute their orders.

And, the smart money is always looking for liquidity to fill their big orders. That’s why the smart money should trigger the stop.

Next:

Rule #2: One Hour before the London Open Should Generate a Breakout

Our backtesting results show that momentum really started to pick up 1 hour earlier than the actual London opening session.

There are some smart ways to launch this momentum break.

Let’s look at some technical ways to trade the pre-London open.

We don’t have to guess where the market is going to break, we let the market tip its hand and show us the way.

This is where things get interesting.

Let me explain…

During the London session, we will see the most traded volume so the foreign exchange market should really take off in one direction or the other.

From our example, we can observe a one-sided move of GBP / USD.

See the forex chart below:

We don’t have any interruptions in momentum activity, and that’s the KEY to this whole trading setup working.

Let’s outline the second technical element you want to see with the London setup.

See below:

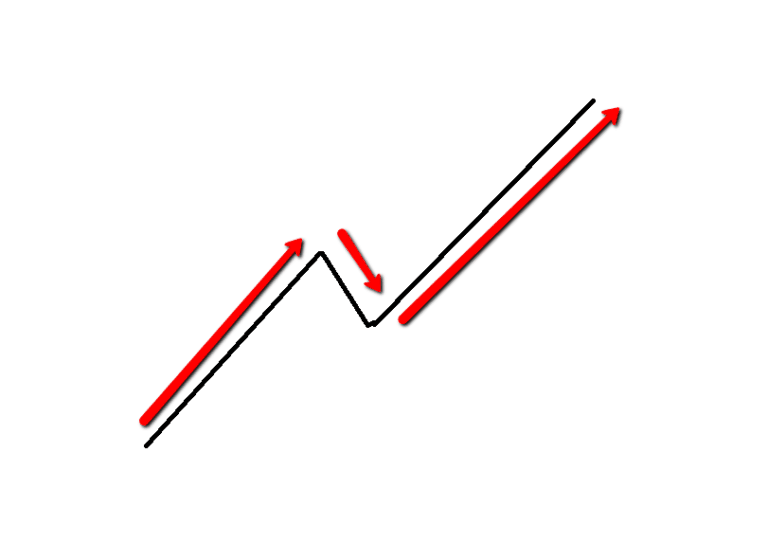

Rule #3 London Open Escape Fade

Immediately after the London session opens, we want to see the price fade the pre-opening move.

If the price move starts to fade, we know it’s a false breakout

The smart money has used a pre-open move to trigger a stop below the range and now they are reversing the rope and starting to buy.

We want to see price pull back into the range at the same speed as it went up.

Let me explain…

In simple words, the bullish momentum used to generate a false breakout should be equal to the bearish momentum used to fade the pre-open move.

We entered our trade after the first 5 minutes had confirmed that the price was reversing.

When this trade setup is complete, you should see a price formation that takes a V-shaped (or inverted V-shaped) shape.

Now let’s explore the methods you can use to get a profit in profits.

See below:

Rule # 4 Take Profits or Ride the Trend

We can measure the size of the Asian trading range and project that, from the top or bottom of our network to get our profit target.

But, simultaneously this type of setup can lead to extended trading days in the coming days.

Let me prove it to you…

See the Forex chart below:

Now, in this case, it is wise if you use other trading tactics so that you can profit from this trend.

For more information on this topic, please check our latest Trend Trading Strategy – Market Rights Section.

In this example, the better take profit strategy is to use a trailing stop.

You need to be willing to explore other trading methods to manage your trades.

Protecting vulnerability is just as important as making money.

Below, we will reveal how to use time as your stop loss.

Sound interesting?

So, let’s get on with it.

See below:

Rule #5 Use Time Stops Instead of Price Stops

To break the London breakout, you need to use unconventional trading methods.

In this case, for our stop loss trading strategy, we will use a time stop instead of a price stop.

The first time I ever heard about the concept of stopping time was reading the book Market Wizards.

Billionaire Hedge Fund Manager Paul Tudor Jones one of the greatest traders of our time said:

“When I trade, I don’t just use price stops, I also use time stops.”

If you want to look into the minds of the most successful traders and hedge fund managers, please read: Top Trading Quotes of All Time – Learn to Trade.

So, do you want to know how to stop time for London strategy?

If in the first hour after the London open the price does not simply reverse the pre-opening breakout, we exit the trade.

It’s as simple as that, no further explanation needed.

Now, let’s explore more London breakout examples using our own twist trading.

See below:

More Examples of London Runaways

Now you might be wondering:

Is the London breakout forex strategy the Holy Grail?

Well, the short answer is NO.

You can’t avoid losses, they are part of the game. No matter how much you twist your trading strategy, losses are the cost of doing business.

We will highlight one trading example, which will reveal that even if everything comes together perfectly, sometimes the trading setup will not work.

First, we set up a London trading range and wait for a breakout before opening.

See an example of a EUR/GBP trade below:

The pre-London open breakout takes place 15 minutes before opening, which is still in line with our London day burn strategy rules.

However, what happens next is important.

The London exchange trading signal has been triggered, but after 1 hour into the London session, the trade has moved slightly against us. So we closed the trade with a small loss.

Our London escape rules are designed to minimize the risk of us being caught red-handed.

I know you’ll enjoy the following examples of London escapes.

On the USD/JPY chart below everything to buy the pre-London breakout.

The scramble took place before London opened and additionally, the move started to fade at the same speed as it went down.

Now, you can see that after we entered, the USD/JPY pair continued to rise.

There is another element to this London breakout trade that adds an extra boost to our signal.

As you can imagine, we are talking about an ongoing uptrend.

Now, with this example, we’ve shown you that when you bring your own edge into the mix, you can tilt the odds even more in your favor.

Moving…

Let’s see what forex currency pairs to trade using the London breakout strategy.

See below:

Ideal Eye Pair for London Escape Strategy

If you really want to kill it with the London breakout trading strategy, you need to know what currency pairs to trade.

Not all currency pairs are equal to the London breakout strategy. Some currency pairs tend to exhibit better trading signals than others. As you might have guessed the best currency pairs to trade the London breakout system are GBP crosses such as GBP/USD, GBP/JPY and EUR/GBP.

Other currency pairs to trade with the London strategy are majors EUR/USD, USD/JPY and AUD/USD.

The highest potential profit is obtained with GBP/USD because during London trading hours liquidity is high as major banks and news activities provide traders with a ton of volatility.

Final Word – London Breakout Trading Strategy

In short, the London breakout strategy can increase your probability of success in the forex market. Now that we know the technical concepts behind the London open make sure you only take setups that are compatible with all the previous rules throughout this trading guide.

If you remember these 3 trading principles, you will have no problem beating traders at their own game:

- Volatility

- Pre-open bullish / bearish momentum fades

- Use stop loss time

If you’re in the US, the bad news is that it’s midnight when London opens. But, the good news is that you can take advantage of the New York open using the same rules adapted for the New York breakout strategy. In fact, some trading strategies will involve using the London open and the New York open on the same day.

Thank you for reading!