Today’s trading strategy is about one of the most reliable continuation patterns, the Bear Flag Pattern. Our flag chart pattern strategy will give you a framework to conquer market trends.

Our team at Trading Strategy Trader is working hard to put together the most comprehensive guide on different chart pattern strategies. To understand the psychology of chart patterns, please start here: Step-by-Step Chart Strategy Guide .

One of the first experiences most day traders learn when they start trading is price action trading. One of the most popular price action patterns you may have heard of is the bear flag pattern.

A bearish flag is a very simple continuation pattern that develops after a strong downtrend.

It doesn’t really matter if your preferred timeframe is a 5-minute chart or if you prefer a longer-term chart. Bear flag patterns appear with equal frequency on all time frames.

Continuation patterns, like bearish flags, bring some good news because they tell you after the market has gone down, it will continue to go down again.

If you missed the initial sell-off, the market is gone without you, and you see a bear flag pattern on the chart, this is a sign and a safe place to sell so you can enjoy the entire downtrend.

We will also provide you with a very clear set of step-by-step rules so that you can trade your own Bear Flag chart pattern strategy.

Moving forward, we will discuss what makes a good bear flag pattern. We will highlight five basic trading rules for conquering the market with the Bear Flag Chart pattern strategy. You can also read simple but profitable strategies.

What is the bear flag pattern?

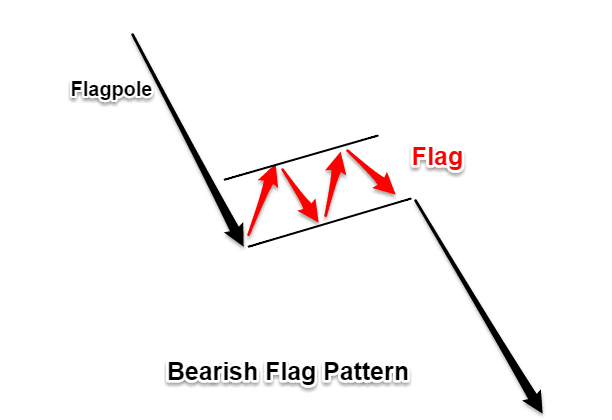

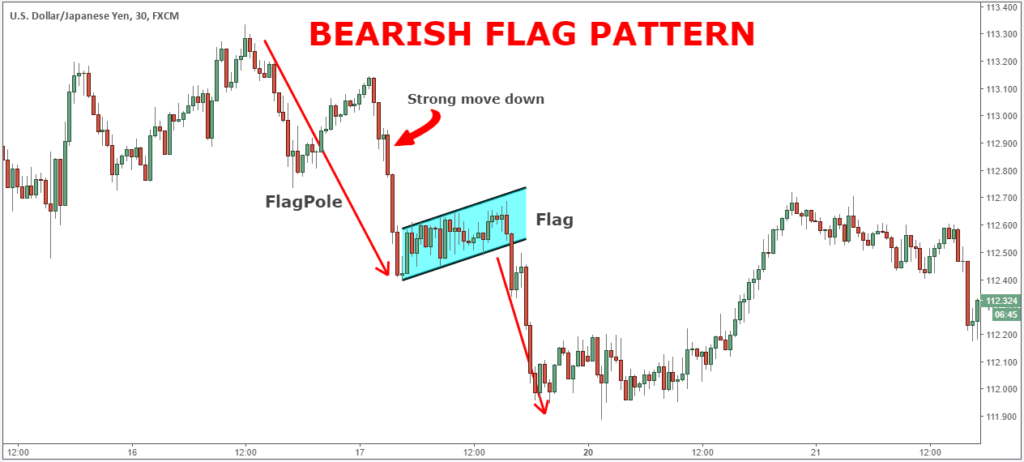

A bear flag pattern is built with a downtrend or downtrend, followed by a break in the trendline or consolidation zone. A strong down move is also called a flag pole while a consolidation is also known as a flag.

A bearish flag pattern comes after a strong move down. The stronger the move, the greater the potential profit.

As you can see in the picture below, after the market made a strong downward move, it entered a consolidation – a very narrow range – to adjust to the new lower price.

Note * For a valid bearish flag, the support and resistance lines that make up the flag need to be parallel and will often slow upwards.

The bearish flag pattern has some similarities to the Rectangle Chart Pattern. The difference is in the square pattern, the price action moves horizontally in a much larger trading range.

The psychology behind the Bearish Flag Pattern

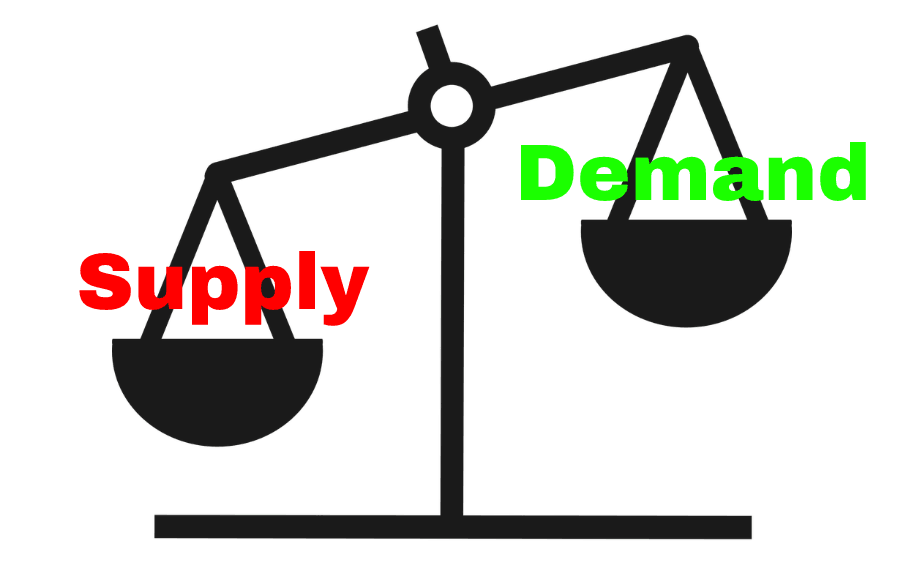

A bear flag pattern highlights a trading environment where the balance of supply and demand is shifting adversely in one market direction (supply > demand). In turn, this will result in very little reverse displacement, which allows the flag structure to form.

After the initial selloff, people who missed the train will panic and start selling. More people will sell it during the flagpole stage.

During a pause or narrow consolidation, people wait for a higher price so they can sell. But since the equation of supply and demand is so unbalanced, this will not happen. We got another smash that will have a lot of people chasing another step down.

Now, let’s see how you can trade effectively with the Rectangle chart pattern strategy and how to make a profit from basically using a naked chart. You can also read about trailing stops or taking hard profits for better trading.

Bear Flag Pattern Strategy – Selling Rules

Now that you’re familiar with weak flag formation, let’s run through a simple step-by-step guide. It will frame a simple trading strategy for you to launch the market.

The best thing about the bear flag pattern is that there is a very easy way to know how low it will send the price of the currency.

We have done something different with the Bear flag chart pattern strategy. We will teach you a new way how to trade bearish flags.

Now is the time to go through the bear flag chart pattern guide step by step:

Step #1: Look for evidence of previous downtrends. For a valid bearish flag, you need to see a sharp decline.

Just because you can see a bear flag pattern, doesn’t mean you should jump into the market and trade.

Remember, we need the right context and the right price structure needs to be appropriate for the price drop flag that can be changed.

Therefore, the first step is to identify the market trend before the formation of the flag price.

First, a valid bearish flag requires a sharp decline. This is strong evidence of a downward trend and imbalanced supply and demand.

Note * The sharp movement is also the Flagpole – the first element of the weak flag structure.

Step #2: Identify the flag price formation. Price action should move within a narrow range between two parallel lines.

The flag price formation is the second element of the bear flag pattern.

Basically, what you need to do is to look for one support and one resistance level. It must contain price action within a very narrow range.

A narrow range is the key to the success rate of bear patterns.

So far, so good.

Now, we need to define the entry technique for our bear pattern strategy.

See below:

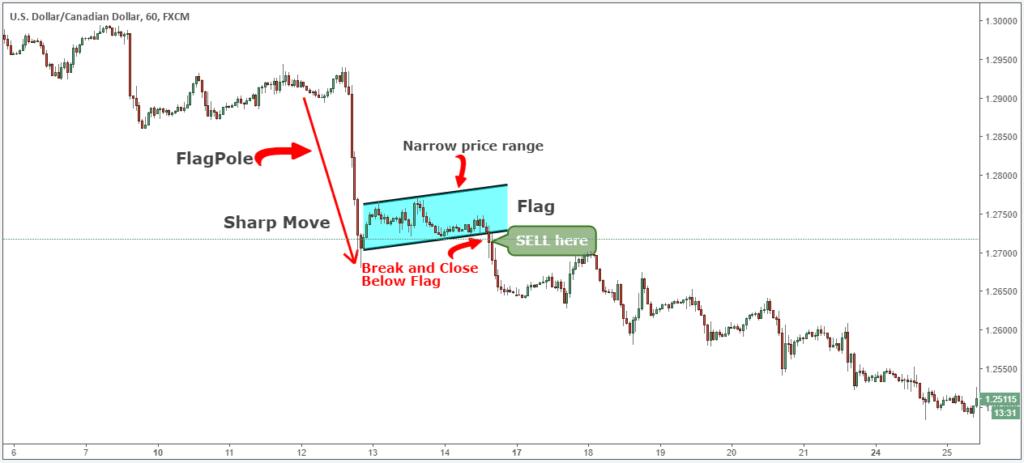

Step #3: Sell the closing candle that produces the Breakout Flag.

After we identify the market trend and the characteristics of a good bearish flag pattern we need to wait for confirmation that the trend will resume.

There are two basic approaches to entering the market with a bear flag pattern. Aggressive traders will enter at the top of the bearish flag as this will result in slightly larger profits.

If you are a conservative trader, you can wait for the confirmation provided by the breakout flag.

Our team at TSG prefers to take a conservative approach and wait for a break and close under a bearish flag before executing a trade.

The bear flag chart pattern strategy only looks for trading opportunities when you get a breakout below the flag price structure to become a seller.

The next important thing we need to determine is to place your protective stop.

It is important when looking at this type of strategy to keep everything in the context of the overall market. Too many traders will try to zoom

See below…

Step #4: Place a protective stop-stop slightly above the Flag.

The Rectangle chart pattern strategy provides you with an easy way to assess risk as you can place your protective stops slightly above the flag price structure.

We are doing two things with a tight stop loss:

- A small loss.

- Higher risk to reward ratio.

With a tight stop loss, you get the comfort of losing many trades in a row because with an amazing RR, a potential bearish flag will wipe out all your losses in one trade and still be profitable.

The next logical thing we need to determine for the bear bear pattern strategy is where to take profit.

See below…

Step #5: Take a Profit target equal to the same price distance from the Flag pole measured from the top of the descending flag.

The textbook target is the height of the flagpole measured from the top of the flag.

Our team at TSG has learned that the market likes this kind of price symmetry and we want to take advantage of it.

Note *** The above is an example of a SELL trade … Use the same rules – but in reverse – for a BUY trade, but this time we will use a bullish flag, or a bull flag. In the picture below, you can see an example of a real BUY trade, using a bullish flag pattern.

The conclusion

Identifying a bearish flag pattern should be an easy task but if you have the right trading conditions then a bearish flag can be a great trading pattern to start growing your account. The main thing about the bear flag chart pattern strategy is that it is a strategy that only works in bear markets and works well.

Please also don’t forget to check out our previous strategy tutorial on trading channel pattern strategy.

Thank you for reading!

Please leave a comment below if you have any questions about this strategy!

Also, please give this strategy 5 stars if you enjoy!