Developing the right skills on how to read crypto charts is an art. This new skill will help you not only track the price of your favorite coins, but crypto candlestick charts will actually tell you about market trends as well.

Our team at Trading Strategy Traders are strong advocates of using charts and technical analysis. Crypto candlestick charts give you a more objective view of cryptocurrency prices versus something a little more subjective like using your intuition.

Market timing is a common problem that many new traders have. If you want to enter and exit accurately, you need to use cryptocurrency charts. You can have a great trading idea and believe Bitcoin will go up, but if you pick the wrong spot, you’ll start losing money left and right.

If you leave too early or you leave too late, you might as well leave money on the table. Using crypto charts in combination with technical analysis, you can balance them.

In this cryptocurrency guide, we will cover just some of the basics on how to read crypto charts and the cryptocurrency analysis tools you need to succeed in this business.

We’ll also outline our favorite cryptocurrency analysis tools and resources for Bitcoin and altcoin trading.

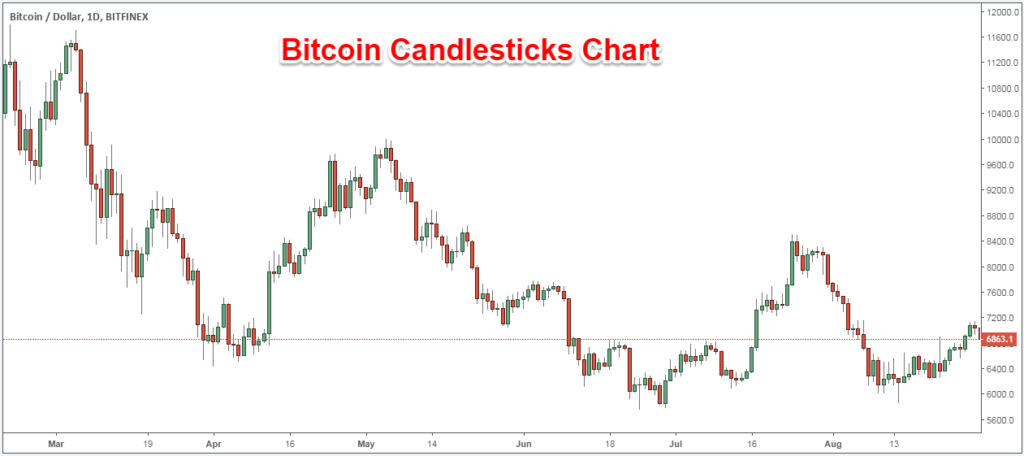

Crypto Candlestick Chart

There are several other different ways to view charts, but our favorite crypto price chart is the candlesticks chart.

Moving forward, we will show you how to navigate the crypto price chart.

Now, these are the key elements of a crypto candlestick chart:

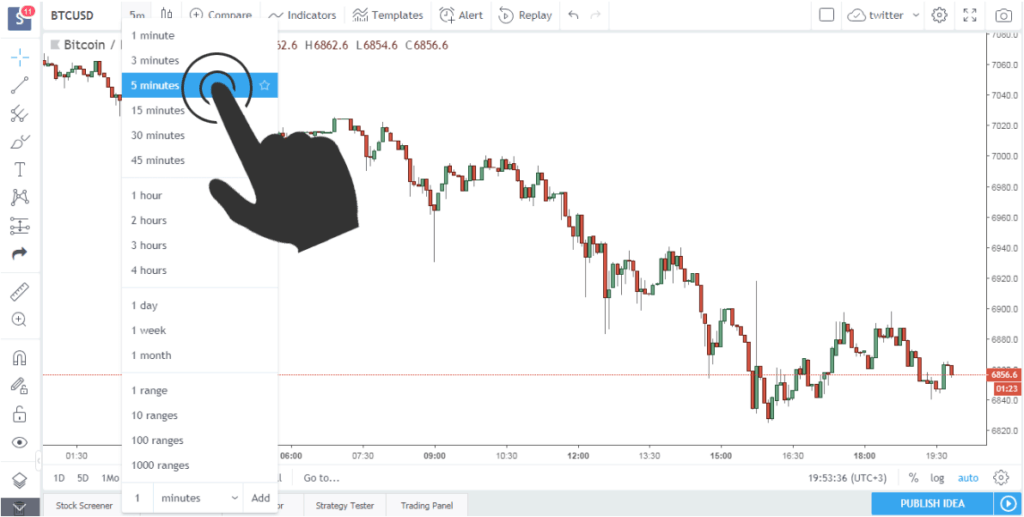

Step #1 Timing Selection

Crypto charts allow you to choose the time frame you want the candle to close. This indicates that the crypto candlestick will show all the transactions that took place in the selected time period.

For example, if your favorite cryptocurrency time frame is a 5-minute chart, then each candle will represent 5 minutes.

Obviously, the time frame can be adjusted to make it more customizable, or you can just choose from the default time frames (5 minutes, 15 minutes, 1 hour, 4 hours, daily, weekly, monthly).

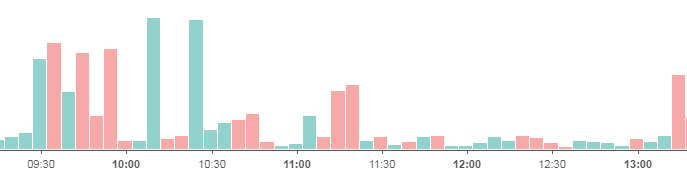

Step #2 Volume

The second thing, the standard cryptocurrency chart will display is the amount. The volume will show you how much trading activity occurred during the selected time frame. Learn more about volume trading strategies here.

The longer the volume bar, the more buy or sell pressure. A green volume bar will highlight increased interest in the coin and buying pressure. Conversely, a red volume bar will highlight a decline in interest in the coin and selling pressure.

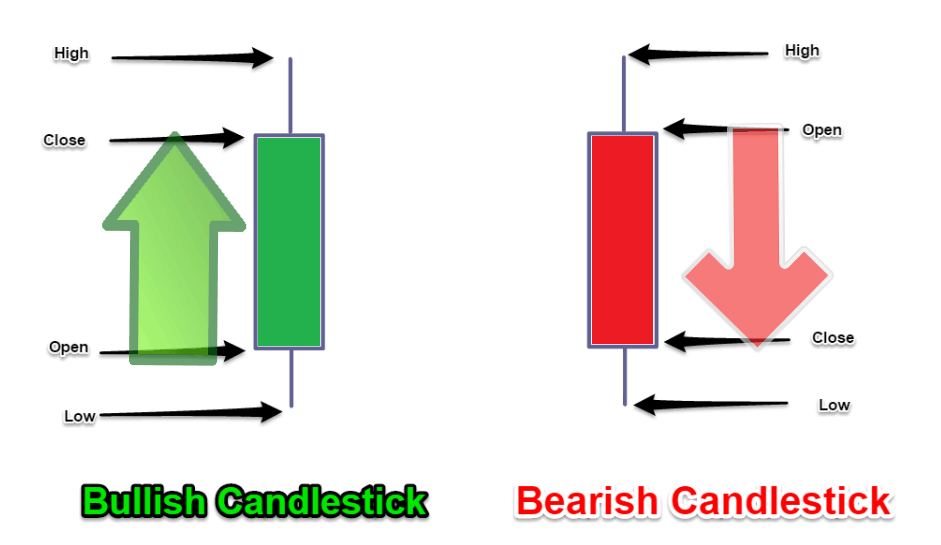

Step # 3 Bearish and Bullish Candlesticks

Third, we need to distinguish that there are two types of candlesticks:

- Bearish candlesticks

- Bullish candlesticks

By default, bullish candlesticks are shown by green candles, which indicate that the price has risen during the selected time frame. For example, if the closing price of a 5-minute candle is higher than the opening price, that is a bullish candlestick.

For bullish candlesticks, the lower part of the thick part represents the opening price while the upper part of the body represents the closing price. Wicks candlesticks represent the highest and lowest prices over the selected time period.

* Note: Apply the same rule in reverse for bearish candlesticks.

Candlesticks come in many shapes and forms. The price formation of these candles is a good way to predict future market trends. There are many candlestick combinations that can predict what will happen next and we call them chart patterns.

To know the information you get from a crypto candlestick chart you need the right tools:

Cryptocurrency Analysis Tool

Now we will share the four best cryptocurrency analysis tools to start trading Bitcoin and other coins. This section is not only for crypto beginners, but it is also dedicated to more experienced traders.

There are many technical tools out there, and you may want to use various combinations in combination. We believe this trading tool will help you avoid coins and lose some of your money or just do better trading overall. Learn about the Best Cryptos to Invest Here.

TradingView’s #1 Cryptocurrency analysis tool

The best cryptocurrency analysis tool we like using FREE TradingView charting software. This charting platform has many hidden capabilities and features that will make your trading smooth.

It’s just a nice tool to have, but it’s not the end-all be-all as there are other tools you can use at your discretion.

It is very easy to set up and use tradingview. It is rich in resources, instruments that you can follow and more importantly

Cryptocurrency Analysis Tool #2 Money Flow Indicator

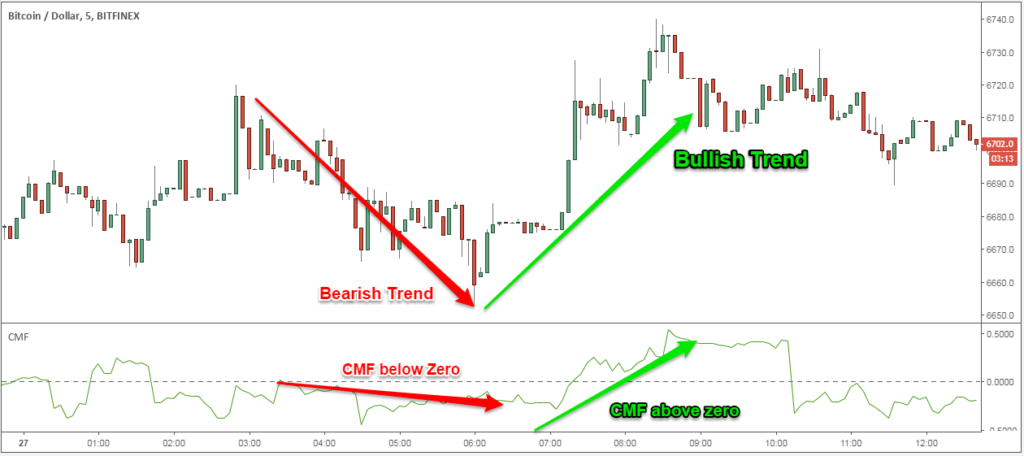

Our second favorite cryptocurrency analysis tool is the Wang Chaikin trend indicator.

The Chaikin Money flow indicator was developed by trading guru Marc Chaikin, who was trained by the world’s most successful institutional investors.

The reason why Chaikin’s Money Flow is the best volume indicator and it is better than the classic volume indicator is because it measures institutional accumulations. So naturally, it shows when institutional traders are buying and selling.

Usually at rallies, the Chaikin volume indicator should be above the zero line. On the other hand, at traders the Chaikin volume indicator should be below the zero line.

Cryptocurrency Analysis Tool # 3 Crypto Fear and Greed Index

Crypto fears and citizenship indices use a lot of information, they gather all that data together with scores and ratings plotted on a graph for you.

When sentiment shows a reading below 20, that’s very scary. Usually, cryptocurrency prices go down and it signals a possible bullish reversal. Conversely, market sentiment readings above 80 indicate extreme greed. In this situation, the cryptocurrency has risen and the fear and greed of the index indicates a possible bearish reversal. For more information, read this guide on Crypto Signals.

Basically, we use fear and greed indices as contrarian indicators. Market sentiment is a powerful thing that drives the market, and when we have extreme readings in market sentiment, that’s when we need to look for a reversal. Also, read this guide on Crypto Trading Bots.

Cryptocurrency analysis tool # 4 Fibonacci Extension

The Fibonacci extension is a very useful tool that can be invoked to spot counter opportunities and even trade reversals. We want to focus on the level of 1.618 or the golden ratio.

There are all kinds of rules, but basically, there are only two things we look for when using Fibonacci extension levels. The first is a trend, the second is a correction that has three reference swing points. We use these swing points to draw Fibonacci extension levels and look for possible reversal points in the market. Read Fibonacci trades here.

The golden ratio can be found everywhere, it is also a “magic number” that we can use in our trading as well. In one way or another, many professional traders incorporate the golden ratio into their trading because the market reacts to certain levels with great accuracy.

Conclusion – Crypto Candlestick Chart

Reading crypto candlestick charts is a practical skill that everyone needs to acquire if you want to make it in today’s challenging cryptocurrency market. While cryptocurrency analysis tools can be valuable weapons in your trading arsenal, you need to use them properly to gain any insight from them.

The crypto candlestick chart can help you better time the market so you can use it as a complementary tool for your research.

This guide outlines only the basic concepts in technical analysis. We recommend strengthening your knowledge and using these tools to build your cryptocurrency strategy that suits your needs. Our TSG blog is rich with trading strategies that can help you achieve your financial goals, so be sure to check out our Best Bitcoin Trading Strategies.

Thank you for reading!

Feel free to leave any comments below, we will read them and will respond.