This guide will help you devise an algorithmic trading strategy to control your emotions while you let the machine do the trading for you. Why would you want to use a high frequency algorithmic trading strategy? What type of bot algorithm is best? All will be explained in this algorithmic trading strategy guide. By the end of this guide, you’ll learn the secret ingredients you need to develop a profitable algorithmic trading strategy.

If this is your first time on our website, our team at Trading Strategy Traders welcomes you. Be sure to hit the subscribe button, so you get Free Trading Strategies delivered straight to your inbox every week.

With the advancement of electronic trading, algorithmic trading has become more popular in the last 10 years. Algo trading started in the 1980s. Today, it accounts for nearly 70% of all trading activity in developed markets.

If you want to improve your knowledge of quantitative trading, we suggest you read Algorithmic Trading Winning Strategies and Its Rationale by Ernest P. Chan. Ernest wrote one of the best algorithmic trading strategy books. What sets this insight book apart from others is its emphasis on algorithmic trading strategies as opposed to theory alone.

Now we answer some of the most common types of questions:

- What is a forex algorithmic trading strategy?

- How do they work?

- Who should trade algo forex strategies?

- And when should you use a forex algorithmic trading strategy?

Let’s start.

What is a Trading Algorithm?

Algorithmic trading is a technique that uses computer programs to automate the process of buying and selling stocks, options, futures, FX currency pairs, and cryptocurrencies.

On Wall Street, algorithmic trading is also known as algo-trading, high-frequency trading, automated trading or black box trading. These terms are often used interchangeably.

If you want to know how high frequency trading works, please check our guide: How High Frequency Trading Works – ABC.

Basically, an algorithm is a piece of code that follows a set of step-by-step operations that are automatically executed. The step-by-step operation is based on the inputs you have programmed into it. Input variables can be price, volume, time, economic data, and indicator readings. Any type of input variable variance can be used.

After these criteria are met, the buy or sell order will be executed.

Next, you will learn how trading algorithms work. You will also learn what you need to do to fully automate your trades:

How Does Algorithmic Trading Work?

Algorithmic trading works by following a three-step process:

- Have a trading idea.

- Turn your trading ideas into trading strategies.

- Trading strategies are converted through algorithms.

Once the algorithmic trading program is created, the next step is backtesting. Backtesting involves using historical price data to check its viability. If the algorithm gives you good backtested results, consider yourself lucky you have an advantage in the market. Finding the edge in the market and then codifying it into a profitable algorithmic trading strategy is not an easy job.

Learn how to create strategy strategies using Backtesting Trading Strategies.

The first (and most important) step in algorithmic trading is to have a profitable trading idea. Before you learn how to create a trading algorithm, you need to have an idea and a strategy.

After you find an advantage in the market, you need to have competence and skills. The best algorithmic traders have competence and skills in these three areas:

- Knowledge of trading and financial markets.

- Quantitative analysis or modeling.

- Programming skills.

What is the best programming language used in algorithmic trading?

Algorithmic trading Python is probably the most popular programming language for algorithmic trading. Matlab, JAVA, C++, and Perl are the algorithmic trading languages used to develop unparalleled black box trading strategies.

Currently, the best coding language for developing Forex algorithmic trading strategies is MetaQuotes Language 4 (MQL4).

Let’s recap what you need to develop your algorithmic trading strategy PDF:

- Trading strategies based on quantitative analysis.

- Choose the right algorithmic trading software that connects to the exchange and executes trades automatically for you.

- Live data for trading.

- Historical price data for backtesting your algo.

- IT infrastructure for high frequency trading. Examples include powerful computers to run advanced mathematical models, servers, backup power, fast internet connections.)

- Colocation facilities have your server installed at a stock exchange location (eg NYSE, if you trade stocks). This will help minimize trade execution and will give you an edge over the competition. Colocation is often used in high frequency trading.

Now let’s see who the market players are. Who is the easiest to use algorithmic trading in the trading landscape?

See below:

Who Uses Algorithmic Trading?

Basically, any experienced trader with coding skills can use programmed trading strategies to trade on his behalf. An individual trader can tap his own algo trading robot to do more than just open buy and sell orders. Algorithms can be used for more complex things like:

- To produce complex mathematical calculations.

- Forecast market movements.

- Generate trading signals.

- risk management

- And others.

The most skilled algorithmic traders are large institutions and smart money. Hedge funds, investment banks, pension funds, prop traders and broker-dealers use algorithms to make markets. These people make up the world’s high-tech elite in algorithmic trading.

Note: Currently market making is done through machine learning. You can learn more about this topic by reading smart market making strategies in algorithmic trading PDF.

Moving forward, we will dive into the types of algorithmic trading strategies.

See below:

Introduction to Algorithmic Trading Strategies

Several algorithmic trading strategies are used to generate profits. Others are used to fill orders. Throughout this algorithmic trading guide, will focus on profit-seeking algorithms. We are not concerned with order management algorithms or order filling algorithms.

An order filling algorithm executes a large number of shares of a stock or futures contract over a period of time. Order filling algorithms are programmed in such a way as to break large-sized orders into smaller pieces. This way it will not move the market against the position taken.

The most popular algorithmic orders and techniques used by smart money are:

- Icebergs

- Time Slice

- VWAP

- TWAP

- PEG / BBBO

The celebrity mentality is to follow the big bucks. If you understand how mass orders can affect the market, you know that if the whole street knows your intentions, you will end up not getting the desired price.

If you intend to buy ABC stock and jump all the way to buy it, the stock price will be artificially pumped higher. This is a classic case of supply and demand.

Next, we will outline the best algorithmic strategy. What are the most common trading strategies used in algo trading? Continue reading.

What is the Best Algorithmic Trading Strategy?

We have various examples of great algorithmic trading strategies. We’ll give you an extensive list so you can see the big trends.

Typically, most high-frequency algorithmic trading strategies will fall into one of the following categories:

- Momentum Strategy

- Mean reversal strategy

- Strategy based on sentiment

- Statistical arbitrage strategy

- Market making strategy

The Algorithmic Trading Superior Strategy and Rationale book will teach you how to implement and test these concepts into your own systematic trading strategy.

Algorithmic Trading Momentum Strategy

Momentum based algos only follow when there is a rise in volatility or ignition of momentum. Algos jump on that momentum with buy or sell orders and tight stops. The idea behind the momentum-based algorithm is simple. Once the ball starts rolling, it will continue to do so until it encounters some kind of resistance.

You can determine market momentum by using indicators and price statistics.

A very easy-to-use automated trading algorithm in the S&P 500 E-mini futures is programmed to feed buy orders when the S&P 500 Emini makes a new intraday level after opening.

Discover some of the secrets and techniques developed by veteran traders for 35 years to day trade Emini futures: Emini Futures Day Trading Strategy.

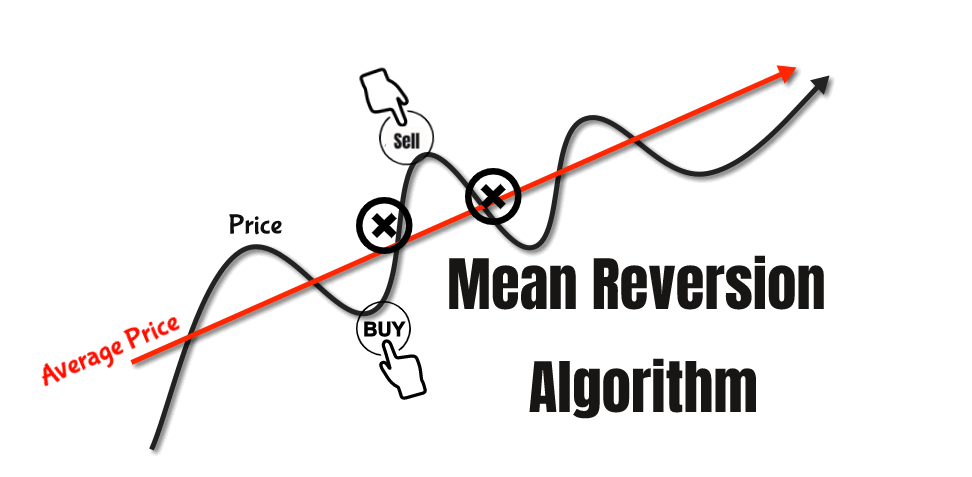

Mean-Reverse Algorithm Strategy

A mean recovery system is another type of algorithmic system that operates under the premise that the market is around 80% of the time. Prices are usually centered on the mean price.

Algorithmic traders use historical price data to determine the average price of a security. They then open buy or sell orders with the expectation that the current price will return to the average price.

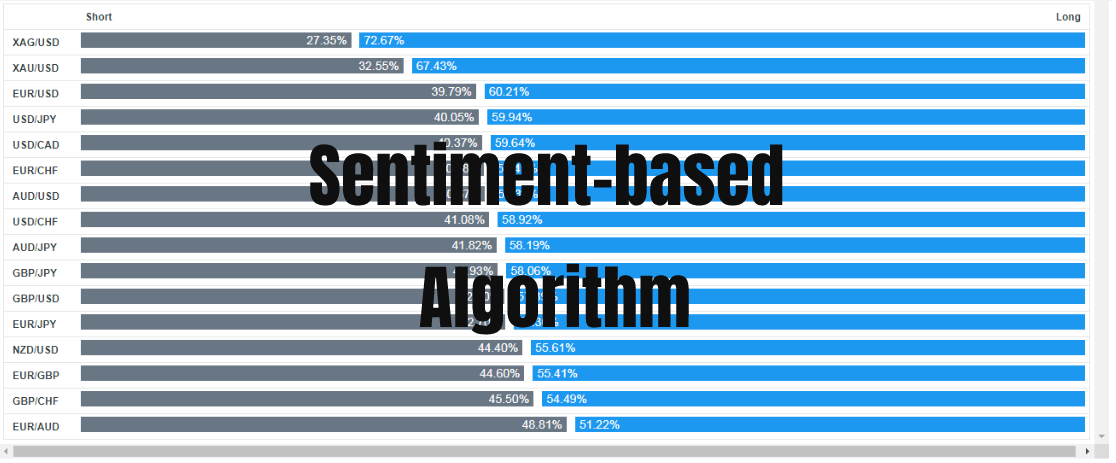

Algorithmic Trading Sentiment Strategy

The algorithm based on sentiment is a news-based algorithmic trading system that generates buy and sell trading signals based on how real data turns out. The algorithm can also read general retail market sentiment by analyzing Twitter data sets. The goal of this algorithm is to predict future price movements based on the actions of other traders.

You need to have sufficient understanding of how financial markets operate and strong skills to develop sentiment trading algorithms.

Market Making Algorithmic Trading Strategies

Market makers, also known as liquidity providers, are broker-dealers who make markets for individual instruments. These can be stocks, bonds, commodities, currencies, and cryptocurrencies. The main job of a market making algorithm is to supply the market with buy and sell prices. Marketing algos can also be used to match buy and sell orders.

One of the most popular market making algorithmic strategies involves simultaneously placing buy and sell orders. These types of market making algorithms are designed to capture spreads.

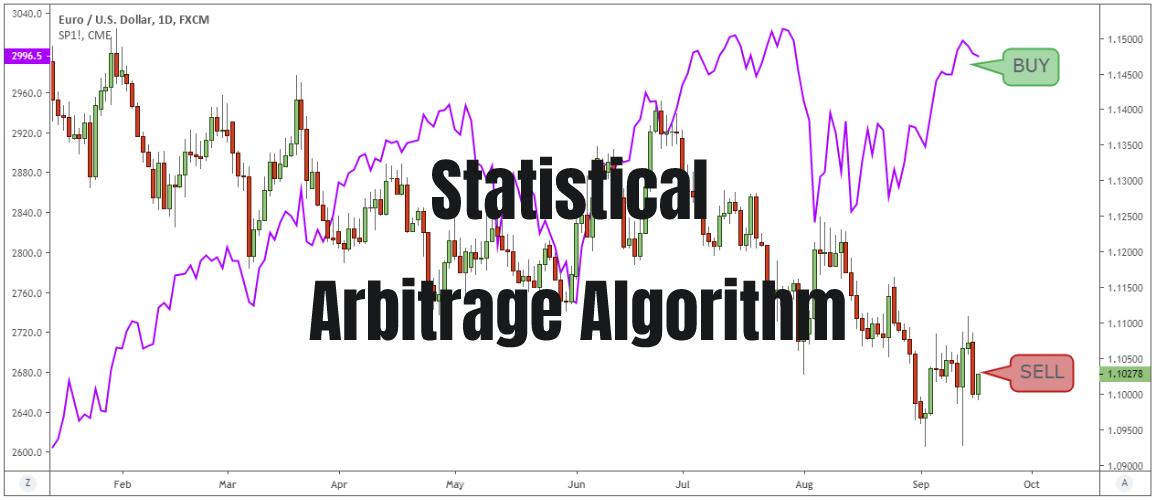

Statistical Arbitrage Algorithmic Trading Strategy

Most statistical arbitrage algorithms are designed to exploit the statistical uncertainty or price volatility of one or more assets. The statistical arbitrage strategy is also referred to as the arb stat strategy and is a part of the mean reversion strategy.

Arb Stat involves complex quantitative models and requires considerable computational power.

The most popular form of statistical arbitrage algorithm is the pair trading strategy. Pair trading is a strategy used to spot the difference between two markets or assets. Pair trading is basically taking a long position in one asset while simultaneously taking an equally sized short position in another asset.

Be sure to check out what our favorite arbitrage trading bots are: How to Make Money from Arbitraging Trading Software before reading on.

Forex Algorithmic Trading Strategy

FX algorithmic trading strategies help reduce human error and the emotional stress that comes with trading. The goal is to build a smart algorithm that can compete with and beat other high frequency trading algorithms.

Most traders do not have the money to pay for powerful computers and expensive collocation servers. Competing with other HFT trading algorithms is like competing with Usain Bolt.

So how can you compete with other quants?

What is the secret to winning this race?

As Sun Tzu said in The Art of War: “Keep your friends close and your enemies closer.”

The best way to follow this principle is to analyze how other Forex algorithms behave and learn their moves.

For example, a dirty secret and standard practice used by many algos is the momentum trigger strategy. This algo aims to cause a rapid rise in price above a certain key level. Usually these algorithms combine support and resistance, swing highs/lows, pivot points or other key technical indicators. This move will encourage other traders to trade behind the move.

The Forex chart below shows you the Forex momentum ignition algorithm in action:

You can train and program your Forex algorithm to respond to this type of behavior. If you have superior programming skills you can build your Forex algorithm system to sniff when other algos are pushing for momentum ignition.

Final Word – Algorithmic Trading Strategy

Developing your algorithmic trading strategy takes time, but the advantages and peace of mind you gain make it worth it. This is a very competitive space that requires superior programming knowledge and skills to be able to develop high frequency trading algorithms.

The rise of high-frequency trading robots has led to a cyber-battle being waged in the financial markets. Forex algorithmic trading strategies have also brought to life several other trading opportunities that smart traders can take advantage of.

Thank you for reading!

Feel free to leave any comments below, we will read them and will respond.