All Forex traders strive to build their own profitable strategies. Well, today is your lucky day! We are ready to share with you the best ADX strategies, built by professional traders. Our team at Trading Strategy Traders is convinced that the easiest way to become a profitable trader is to imitate the behavior of professional traders.

We have talked a lot about trend trading strategies. You can find many proofs here: MACD Trend Following Strategy – Easy to learn Trading Strategy, here: How to Profit from Trading Pullbacks and here: Swing Trading Strategies that Work.

However, we do not cover how to measure the strength of a trend over any possible time period. You can only measure the strength of the trend by using special trading indicators. For example, ADX, which is the abbreviation of A T annual Directional I Ndex.

Spotting strong directional moves is the most important skill for all traders. No matter what type of trader you are, after you enter a position you need a strong directional move. To make a profit, the move must be in the direction of your trade.

ADX indicator trading rules can help you achieve your financial goals.

Before moving forward, we must determine which technical indicators we need for the best ADX strategy. We will define the trading rules of the ADX indicator. Also, read the hidden secrets of moving averages, for more information.

ADX Indicator for Future

The Average Directional Index principle can be applied to almost any tradable asset including stocks, exchange traded funds, mutual funds, and futures contracts. ADX has become very useful in the futures market for many reasons:

- With a standard range of 14 bars, ADX offers a “bigger picture” than other technical indicators.

- The ADX is time adjusted, which means that the most recent data is given exceptional weight.

- ADX helps you identify the strength of the trend, which will be useful for any contracts executed in the near future.

- ADX makes it very easy to compare mutually exclusive futures contracts at once.

Futures traders enjoy using ADX as a metric because it offers a perfect blend of past and present data and future predictions. Successfully buying futures contracts requires you to identify potentially wrong contracts in the status quo. Using regular ADX readings for futures contracts makes this possible.

Using ADX readings for major indexes (such as the DJIA, S&P 500, etc.) can also help you identify whether the general market is in a bearish or bullish state.

ADX Indicator Trading Rules

Before getting into the rules of trading the ADX indicator, let’s define what the ADX indicator is and how you can profit from it.

The ADX indicator only measures the strength of the trend and whether we are in a trading or non-trading period. In other words, ADX is an indicator of trend strength. This method of technical analysis is used to identify the emergence of strong downtrends and buy signals.

We need to be careful about how we read and interpret the ADX indicator. It is not a bullish and bearish indicator. The ADX moving average only measures the strength of the trend.

So, if the price will be UP, and the ADX indicator will also be UP, then we have a case for a strong bullish case.

The same is true if the price is going DOWN and the current ADX indicator is UP. Then we have a case for a strong bearish case.

The first trading rule of the ADX indicator says that a reading below 25 indicates a non-trading period or a similar market. The second ADX indicator trading rule says, when the ADX is above 25 it is sufficient to signal the presence of a strong price trend/uptrend.

Moving forward, keep in mind that the ADX indicator does not give you information about market direction. It only gives you information about the strength of the trend.

ADX indicator settings

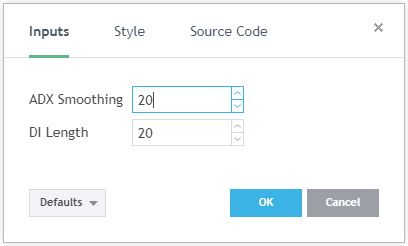

The ADX indicator uses a smoothing moving average in its calculations. We know that the best ADX indicator setting to use is 14 periods. With our ADX indicator settings, you will have more accurate signals and it will help you get trades earlier.

The ADX indicator works well when used in conjunction with other technical indicators.

The best ADX strategies also incorporate the RSI indicator to time the market. The ADX indicator can only help us to measure the intensity of the trend. We need RSI indicator for entry signal.

The RSI uses a 20-period setting, which is the same as the ADX indicator setting.

Finally, your chart setup should have below both the ADX and RSI indicators. It should be the same as the figure below.

Now, let’s see how you can trade with the best ADX strategy. You will learn how to make a profit by using ADX indicator trading rules.

Best ADX Strategy

ADX indicator trading rules will ensure that you only trade when there is a strong trend on the 5-minute chart or the daily chart. In this regard, the best ADX strategy is a universal strategy that does the same thing, regardless of the time frame used.

Going forward, we will look for sales opportunities.

Step #1: Wait for the ADX indicator to show a reading above 25.

Before we see whether the market is up or down, we should first wait for the ADX indicator to show a reading above 25. Based on the trading rules of the ADX indicator, a reading above 25 indicates a strong trend and the possibility of a developing trend.

We all know that the trend is our friend, but without a real force behind the trend, the new trend that is formed can quickly fade away.

To measure the direction of the trend, we also need to look at the actual price action. This brings us to the next step of the best ADX strategy.

Step #2: Use the last 50 candlesticks to determine the trend. For sell signals, look for the price to develop a downtrend.

Regardless of your time frame, we need a practical way to determine trend direction.

By using a sample size of 50 candlesticks to determine the trend we ensure that we are trading at the current moment. We like to keep things simple, so if the price is heading down on the last 50 candles we are in a downtrend.

Now, it’s time to focus on the catalyst that will trigger our sell signal for the best ADX strategy.

Step #3: Sell when the RSI indicator breaks and shows a reading below 30.

For our entry signal, we will use the RSI indicator which uses the same settings as the ADX indicator settings. Usually an RSI reading below 30 indicates an oversold market and a reversal zone. However, smart trading means looking at what the textbooks say.

In a strong trend as defined by the ADX indicator that is exactly what we want to see. We want more sellers to enter the market.

Therefore, we want to sell when the RSI indicator breaks and shows a reading below 30.

The next important thing we need to determine is to place your protective stop.

See below…

Step #4: Stop Protection should be placed at the last ADX high.

To determine the stop location for the best ADX strategy, first identify the point where the ADX made its last high before our entry. Second, find the same high on the price chart from the ADX high and there you have your SL level.

Last but not least the best ADX strategy also requires a place where we need to take profit, which brings us to the last step of this unique strategy.

Step #5: Take Profit when the ADX indicator turns below 25.

The best ADX strategies aim only to capture profits generated from the presence of a strong trend. When the prospect of a strong trend disappears we will take profit and wait for another trading opportunity.

To achieve this, we take profit as soon as the ADX indicator turns below 25.

An ADX reading below 25 suggests an ongoing trend.

Note ** Above is an example of a SELL trade using ADX indicator trading rules. Use the same rules but in reverse, for BUY trades. In the picture below you can see an example of a real BUY trade.

Take a look:

Conclusion – ADX Indicator

The best ADX strategy gives us very useful information because a lot of the time, we as traders don’t want to get into something that moves everywhere and doesn’t grow in a strong way. By using the ADX indicator trading rules one can take advantage of the strength of the trend and cash in with quick profits. The bottom line is that the best profits come from catching strong trends and the best ADX strategies can help you achieve your trading goals.

You can also read about the Trader Profile Quiz.

The best ADX strategy is the same as the Best Momentum Trading Strategy for Quick Profits because both strategies seek to take advantage of the strength of the trend.

Thank you for reading!