In this article, you will find out how to use Bollinger bands in day trading. This strategy uses two of the most popular trading indicators in the market, Bollinger Bands and RSI. They are used to simply look for price “bounces” that occur during major trends.

If you’ve been looking for a Bollinger band trading strategy that works, you’ll want to pay special attention.

This special strategy teaches you how to read Bollinger Bands and Bollinger Bands signals. You will also learn about Bollinger Bands squeeze, Bollinger double band strategy, Bollinger Bands secrets, and more. We also have training for the ADX Indicator.

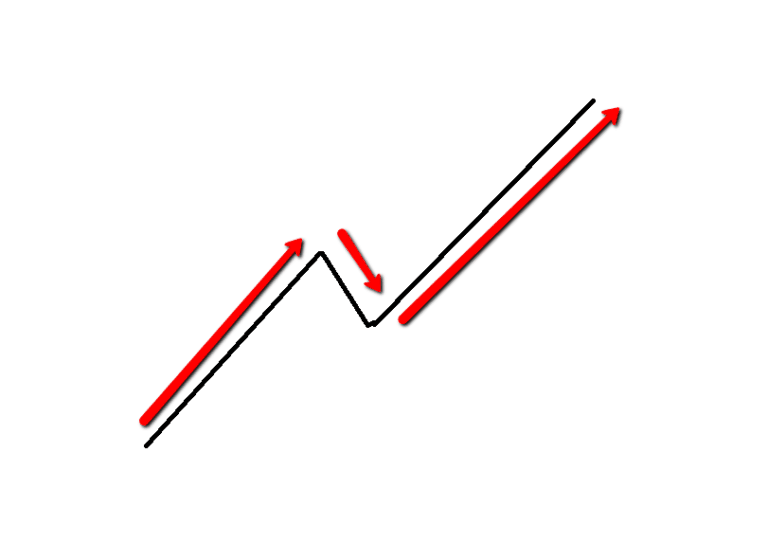

Something will look like this:

How to Use the Bollinger Band Indicator

Bollinger Bands are well known in the trading community. You can get a great Bollinger band formula with a simple trading strategy.

They were invented by John Bollinger in the early 1980s. The purpose of this group is to give a relative definition of high and low. So in theory, the price is high on the upper band and then low on the lower band. Bollinger Bands contain three different lines. Upper, middle, and lower bands. The middle band basically serves as the base for both the top and bottom.

They are mainly used when determining when there is an overbought or oversold level. Sell when the price touches the upper band and buy when the price touches the lower band.

The distance between the lower, upper and middle bands is determined by volatility. The middle band consists of an average of 20 moving periods. Top and bottom are two standard deviations below and above the center moving average. Standard deviation is a statistical measure that offers a big picture of price volatility.

When you see a widening band that just means that there is volatility at that time. When the price moves a little, the band will be narrow which means that there is little volatility.

I prefer to use this trading strategy using 1-hour or 4-hour time charts. You can customize according to your trader’s style. But the example I will show you will use 4 hour and 1 hour time chart.

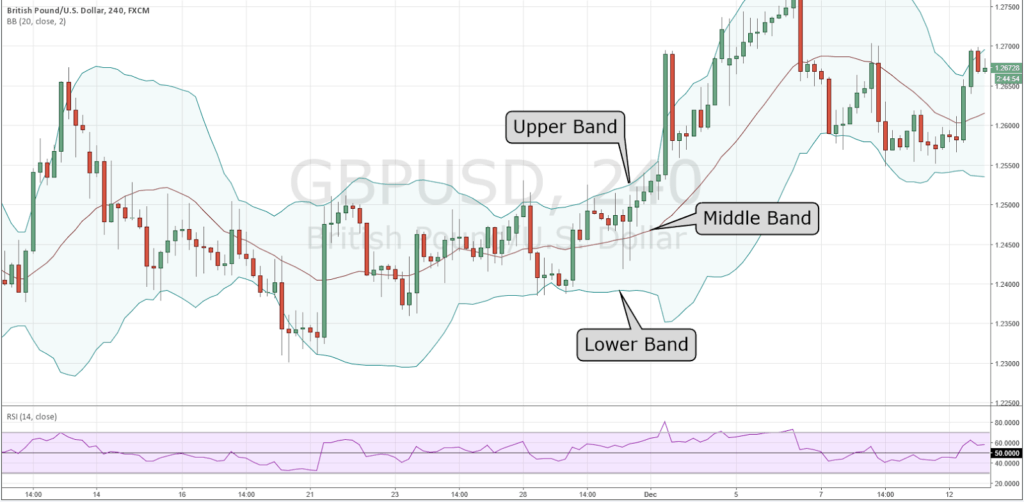

Before we start looking at the rules of the strategy, let’s look at the Bollinger bands. Let’s see what they will look like on the chart if you have never used this type of indicator in the past:

After examining the picture, it may seem wise to buy whenever the price hits a lower band. Or, conversely, sell whenever the price hits the upper band. This can technically work but is a risky way to trade using Bollinger Bands. Sometimes a strong trend will ride these bands and end up stopping many unfortunate traders who use that method. This is why we use the RSI indicator to help confirm and trade the “bounce” of an upper or lower band. Also, read how banks trade in the forex market.

The RSI indicator is used in this strategy to see how the currency is weakening or strengthening. (Click here for other RSI trading strategy articles).

These indicators should be standard on your trading platform. There is no need to adjust this, as we will use the default settings. Here you can learn how to fade momentum in Forex Trading.

I would suggest drawing a horizontal line at the 50.00 level in the RSI indicator before starting. You’ll soon find out exactly why.

Trading Indicators Used with Bollinger Bands Bounce Trading Strategy:

- Bollinger Bands (20, 2)

- RSI Indicator (Relative Strength Index) (14)

How to Buy Low and Sell High

In theory, Bollinger Bands will contain all trading activity that occurs within 2 standard deviations of the expected norm (trend line).

This means that around 90-95% of price movements will occur within this range.

Bollinger Band traders look for patterns of resistance and support. Examples of support occur when demand has become “concentrated” and a downtrend may lose momentum. Conversely, a resistance situation occurs when an uptrend is “condensed” and is likely to reverse downwards in the near future.

Bollinger Bands make it easy to buy low and sell high. Traders will open positions when the trend line approaches the bottom of the Bollinger Band range. Traders should close positions when the trend line reaches the top of the range.

Rules for Bollinger Band Bounce Trading Strategy

* To make it simple, I will use the same example (4-hour GBPUSD chart) for each of these rules. This trade will be a “BUY” trade. Rules are the same concept just opposite to SELL trading. The currency is upgrading and then it will return to the lower Bollinger Band. From there, if it complies with the rules, we will execute the trade.

Rule #1: Look for currencies that are in an Uptrend / Downtrend.

Finding trending markets is very easy. You can use price channels, trend lines, Fibonacci lines, to determine the trend. Look for higher highs or lower lows and place trend lines on them. If the line goes up, it is an uptrend, if it goes down, it is a downtrend. It should go up or down, not a horizontal trend.

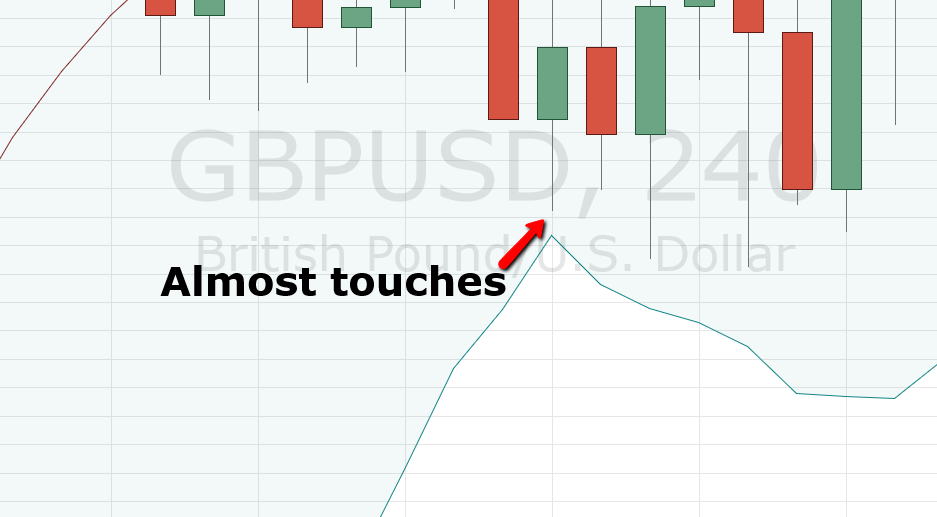

Rule #2: The currency must be down (from an uptrend) and touch, or nearly touch, the lower band.

When I say “Almost touching” an example would be something like this

** Bollinger Band trading tips: If it is more than 5 pips then I will not consider this confirmed, and I will wait to approach the lower / upper band.

As you can tell in the price example the price came back down, from the upside, and touched the bottom band.

Once the price touches the bottom or top, look at the RSI indicator for confirmation.

Rule #3: Once the Price touches the lower Bollinger Band, look at the RSI indicator and it should be between 30-50 and rising.

The price hits the Bollinger Band, the RSI (when the price touches the lower band) should be between 50 and 30. If it is not here, and let’s say it is at the 80 mark, then you will not be interested in trading.

You want to see the RSI go up, in this case, in the direction of the trade. Remember that it must be between 30-50 marks. (In a sell trade, the RSI should be between the 50-70 mark and go down.)

Once you see this movement you go ahead and look for entries.

Rule #4: After the price hits the lower Bollinger Band, and the RSI is going up, make an entry when…

You can make an entry when you see a STRONG BOOK candle to the upside, a consecutive reversal candle to the upside, or you find a bullish pattern. You need to see that the trend is moving up, in this case, before you enter the trade.

If the candlestick moves to the point where it makes a new low, this would not be a good time to enter the trade. However, when the candle fails to make a low watch to see if it forms a bullish formation. Here is an example of a master candle setup.

In this example, I met with an hourly chart to make an entry. This is very good to do. This can give you a more precise place to make an entry point. As I said, the 4 hour and 1 minute time frame is the preferred time frame for this strategy. Yes, less opportunity to trade, but very strong signals when in higher time frame.

Rule #5: Stop Losses / Taking Targets

Always remember to place a stop loss, and have a good target area. With this strategy, we recommend using a stop of 30-50 pips.

You can take profit when the price touches the other Bollinger Bands.

The conclusion

Bollinger Bands are a great indicator to use in any market. When you combine it with the RSI indicator, it should give you a great entry point. Here is another strategy called volume trading in Forex.

Something you can consider is when the price touches the middle band. You can make a second post to press your winner. This can potentially give you double profits. With this strategy, we only use the one trade we made in the beginning. But if your rules allow you to make multiple trades at a time with the same currency pair, then you can consider adding a second position in the middle row.

Click here to read another great trading strategy! This requires no indicators, just pure price action!