The exponential moving average is the oldest form of analysis. It is one of the most popular trading indicators used by thousands of traders. In this step-by-step guide, you will learn a simple exponential moving average strategy. Use what you learn to change your trades and become a successful long-term trader! Moving averages can be very effective indicators. Many traders use exponential moving averages, an effective type of moving average indicator, to trade in various markets.

The exponential moving average strategy, or EMA strategy, is used to identify major trends in the market. It can also provide support and resistance levels to execute your trade.

Our team at Trading Strategy Traders has covered the topic, the following systems follow trends. You can study the trend here, MACD Trend Following Strategy – Simple to Learn Trading Strategy. You can also learn the basics of support and resistance here, Support and Resistance Zones – The Road to Successful Trading.

Be sure to continue the recommended articles if you want to better understand how the market works. Building a foundation of understanding will help you dramatically increase your results as a trader.

The Exponential Moving Average EMA strategy is a universal trading strategy that works in all markets. These include stocks, indices, Forex, currencies, and crypto-currency markets, such as the virtual currency Bitcoin. If exponential moving average strategies work on any type of market, they work for any time frame. Simply put, you can trade with the chart of your choice. Also, read the hidden secrets of moving averages.

Let’s first start with what a moving average is and the formulation of an exponential moving average. After, we will dive into some key rules of the exponential moving average strategy,

Exponential Moving Average and Exponential Moving Average Formulas Explained

An exponential moving average is a line on a price chart that uses a mathematical formula to smooth price action. It shows the average price over a certain period. The EMA formula gives more weight to recent prices. This means it is more reliable because it reacts quickly to the latest data price changes.

Exponential moving averages attempt to reduce confusion and noise from daily price action. Second, moving averages smooth prices and reveal trends. It sometimes reveals patterns you can’t see. Averages are also more reliable and accurate in predicting future changes in market prices.

There are 3 steps to the exponential moving average formula and calculating the EMA. The formula uses the average moving average of the SMA as the starting point for the EMA value. To calculate SMA, take the total number of times and divide by 20.

We need multipliers that make moving averages put more focus on the most recent prices.

The moving average formula brings all these values together. They form a moving average.

The exponential moving average formula below is for the 20-day EMA:

Initial SMA = 20-time sum / 20

Multiplier = (2 / (Time period + 1)) = (2 / (20 + 1)) = 0.0952 (9.52%)

EMA = {Close – EMA (previous day)} x multiplier + EMA (previous day).

The general rule is that if the price is trading above the moving average, we are in an uptrend. As long as we are above the exponential moving average, we should expect higher prices. Conversely, if we trade below, we are in a downtrend. As long as we are trading below the moving average, we should expect lower prices.

Before we go any further, we always recommend writing down the trading rules on a piece of paper. This training will increase your learning curve and you will become a better trader.

Let’s start…

Exponential Moving Average Strategy

(Trade Rules – Sell Trade)

Our exponential moving average strategy consists of two elements. The first step to catch a new trend is to use two exponential moving averages as an entry filter.

By using one moving average with a longer period and one with a shorter period, we automate the strategy. This removes any form of subjectivity from our trading process.

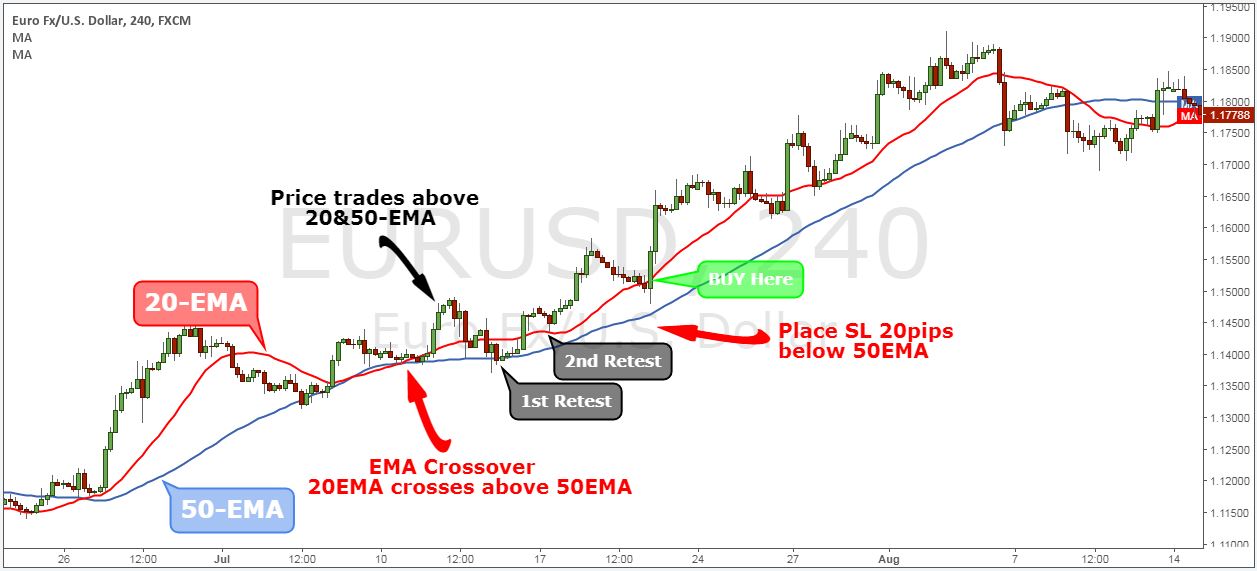

Step #1: Plot on your chart the 20 and 50 EMA

The first step is to properly set up our chart with the correct moving average. We can identify the EMA crossover at the final stage. The exponential moving average strategy uses the EMA and 20 period EMA.

Most standard trading platforms come with a default moving average indicator. It shouldn’t be a problem to spot the EMA on either your MT4 or Tradingview platform.

Now, we’re ready to take a closer look at the pricing structure. This brings us to the next step of the strategy.

Step #2: Wait for the EMA crossover and the price to trade above the 20 and 50 EMA.

The second rule of this moving strategy is the need for price to trade above both the 20 and 50 EMA. Second, we need to wait for the EMA crossover, which will add weight to the bullish case.

We refer to an EMA crossover for a buy trade when the 50-EMA crosses the 50 EMA.

By looking at the EMA crossover, we create automatic buy and sell signals.

Since the market is prone to false breakouts, we need more evidence than a simple EMA crossover. At this stage, we don’t know if the bullish sentiment is strong enough to push the price down after we buy to make a profit.

To avoid false breakouts, we add new encounters to support our view. This brings us to the next step of the strategy.

Step #3: Wait for the zone between the 20 and 50 EMA to be tested at least twice, then look for a buying opportunity.

The confidence behind this moving average strategy depends on various factors. After the EMA crossover occurs, we need to be patient. We will wait for two zones in a row and succeed between the 20 and 50 EMA.

Both retests of the zone between the 20 and 50 EMA managed to give the market enough time to develop a trend.

Don’t forget that no price is too high to buy into the trade. And no price is too low to sell.

Note * When we refer to the “zone between the 20 and 50EMA,” we do not actually mean that the price should trade in the space between the two moving averages.

We just want to cover the entire price spectrum between the two EMAs. This is because the price will only briefly touch the moving average (20-EMA). But this still works.

Now, we still need to decide where we will buy. This brings us to the next step of the strategy.

Step #4: Buy the market when we retest the zone between the 20 and 50 EMA for the third time.

If the price manages to repeat the zone between the 20 and 50 EMA for the third time, we go ahead and buy at the market price. We now have enough evidence that bullish momentum is strong to continue pushing this market higher.

Now, we still need to determine where to place the protective stop loss and where to take profit. This brings us to the next step of the strategy.

Step #5: Place a protective Stop Loss 20 pips below the 50 EMA

After the EMA crossover occurs, and once we have two in a row, we know the trend is over. As long as we trade above both exponential moving averages the trend remains intact.

In this case, we place our protective stop loss 20 pips below the 50 EMA. We add a buffer of 20 pips because we understand we don’t live in a perfect world. The market tends to fake acne.

The final part of our EMA strategy is the exit strategy. It is based again on an exponential moving average.

Step #6: Take Profits once we break and close below the 50-EMA

In this case, we do not use the same exit technique as our entry technique, which is based on the EMA crossover.

If we wait for the EMA crossover to occur on the other side, we will give back potential profits. We need to consider the fact that the exponential moving average is a lagging indicator.

The exponential moving average formula used to plot our EMAs allows us to continue taking profits right when the market is about to reverse.

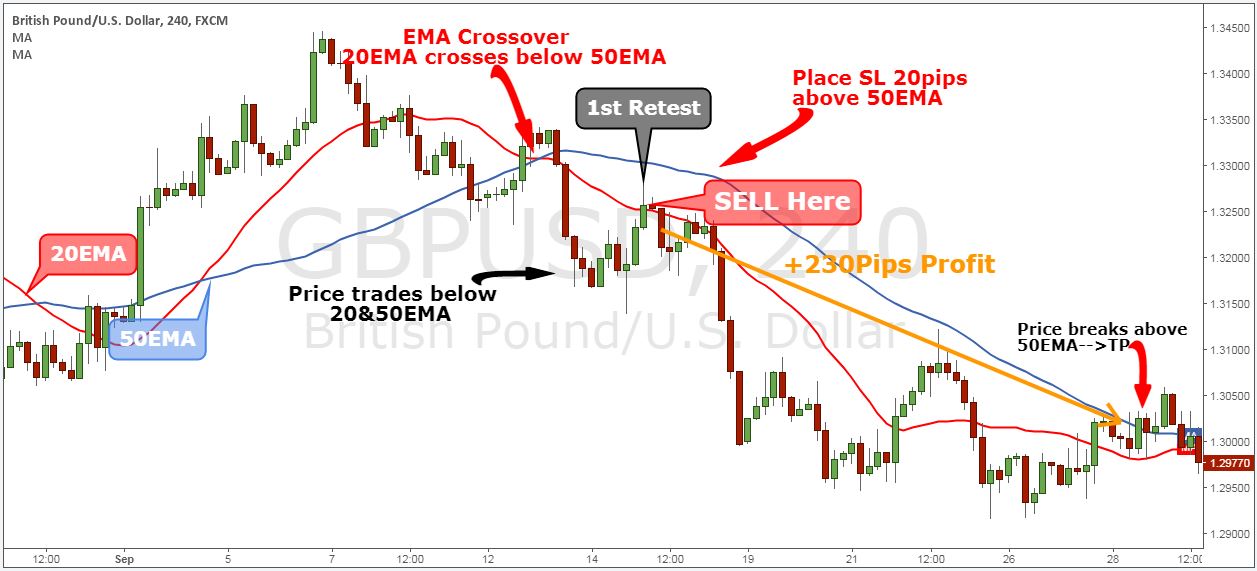

Note ** The above is an example of a BUY trade. Use the same rules – but in reverse – for SELL trades. However, as the market went down faster, we sold on a retest of 1 zone between 20 and 50. After the EMA crossover occurred.

In the picture below, you can see an example of a real SELL trade, using our strategy.

Summary

The exponential moving average strategy is a classic example of how to build a simple EMA crossover system. With this exponential moving average system, we are not trying to predict the market. We try to react to current market conditions, which is a better way to trade.

The advantage of our trading strategy is in the exponential moving average formula. It launches a smoother EMA that provides better entry and exit.

We understand there are different trading styles. If the following term trends are not for you, try reading our Best Short Term Trading Strategies – Profitable Short Term Trading Tips. It reveals short-term trading tricks used by institutional traders.

Thank you for reading!